Advertisement|Remove ads.

India Market Watch: Nifty Drops Below 24,600 Ahead Of Weekly Options Expiry; Tech Stocks Sink

Indian equity markets opened sharply lower on Thursday, mirroring weakness in global peers and setting the tone for a volatile weekly options expiry session.

As of 9:40 a.m. IST, the Nifty 50 had plunged 227 points to 24,585, while the Sensex dropped 725 points to 80,870.

The selloff was broad-based, with the Nifty Midcap index down 0.7%, reflecting pressure across the board.

Sectoral indices painted a sea of red, led by steep declines in IT, FMCG, and auto stocks.

Indian tech stocks came under significant selling pressure after the Nasdaq tumbled overnight. Heavyweights like Tech Mahindra, HCL Tech, Infosys, and Wipro were down over 2% each in early trade.

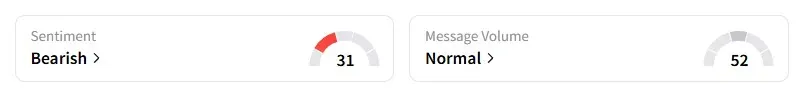

Retail sentiment on Stocktwits for the Nifty 50 remains ‘bearish’, adding to the cautious undertone.

IndusInd Bank initially sank 4% among individual stocks at the open but reversed course to trade over 2% higher, making it the top gainer on the Nifty.

The bank reported its first net loss in nearly two decades, which prompted downgrades from multiple brokerages. This was its first earnings report after revelations of accounting discrepancies and ongoing regulatory audits.

InterGlobe Aviation (IndiGo) fell 0.5% despite strong March-quarter results. Morgan Stanley reiterated its Overweight rating with a target of ₹6,502, implying a potential 19% upside from current levels.

On the downside, Colgate-Palmolive slipped 4% after its quarterly revenue and margins fell short of Street expectations. Goldman Sachs downgraded the stock to Sell with a target price of ₹2,630.

Mankind Pharma also lost 3% after its FY26 guidance underwhelmed investors.

In the midcap space, VA Tech Wabag surged 7% following a steady set of earnings for Q4.

NTPC Green continued its winning streak, rallying another 7% in today’s session.

Investors will monitor ITC, Grasim, and Sun Pharma, among others, as they report quarterly numbers later in the day.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Prabhat Mittal pegged immediate support for the Nifty at 24,680 and resistance at 24,920, while he placed Bank Nifty support at 54,600 and resistance at 55,300.

A&Y Market Research sees Nifty (intraday) support between 24,455 - 24,507 with resistance at 24,746 - 24,811. For the Bank Nifty, they peg resistance at 55,443 - 55,557 and support at 54,334 - 54,470.

Asian markets traded lower, tracking weak handover from Wall Street amid concerns over the U.S. fiscal deficit.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)