Advertisement|Remove ads.

Nifty Holds 25,000 Led By Rally In Midcaps, Rail And Defense Stocks; SEBI RA Sees More Upside

Indian equity benchmarks closed lower on Friday, dragged by profit booking. However, the Sensex and Nifty posted gains of around 4% for the week, reflecting renewed investor optimism.

Nifty ended above the psychological 25,000 mark, while Sensex fell 200 points to 82,330 on Friday.

Broader markets outperformed, with the Nifty Midcap 100 index gaining 1% on Friday and logging its biggest weekly gain in two months.

Sectorally, technology stocks were the biggest laggards in Friday’s trade. Pharma and select metal names also saw profit booking. The FMCG, real estate, and oil and gas sectors witnessed strong buying.

Defense stocks saw strong traction for the sixth consecutive session, with the Nifty Defence Index hitting a 52-week high. Bharat Electronics (BEL) surged 4%, emerging as the top Nifty gainer. Paras Defence closed 20% higher, followed by Cochin Shipyard (+11%), Mazagon Dock and Data Patterns (both +9%), and GRSE (+8%).

Railway stocks also witnessed euphoric buying: RITES jumped 15%, Titagarh Wagons ended 13% higher, and RVNL gained 10%. Other railway names like IRCTC, IRCON, and Texmaco saw gains of 3% to 7%.

Vodafone Idea rose 2% after approaching the Supreme Court for relief on adjusted gross revenue (AGR) dues, warning of a potential shutdown by FY26 without financial aid.

On the other hand, Bharti Airtel fell 3% following a ₹13,000 crore block deal by Singtel, which offloaded a 1.2% stake.

JSW Infrastructure slipped after 2% equity changed hands in a block deal, with the Jindal Family Trust trimming its stake.

Crompton Greaves surged 7%, hitting a two-week high on the back of strong March-quarter results.

IndusInd Bank reversed early losses to end 0.5% higher, despite news of another accounting lapse.

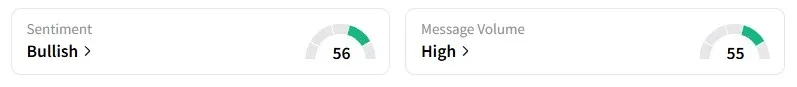

Retail investor sentiment on Stocktwits shifted to ‘bullish’ on the Nifty 50, a strong rebound from the ‘bearish’ outlook earlier in the week.

SEBI-registered technical analyst Ashish Kyal shared a bullish outlook based on the Know Sure Thing (KST) momentum indicator, which remains in a positive zone.

According to Kyal, the Nifty 50 is gaining acceptance at higher levels, suggesting sustained upward momentum. He identified 24,840 as key mid-level support, and expects the index to advance toward 25,300 or higher, provided this support holds.

Globally, sentiment was positive. European markets traded higher, and U.S. futures pointed to a strong open.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)