Advertisement|Remove ads.

Market Wrap: Nifty Reclaims 24,000, Bank Index At New High; Suzlon, Vodafone Idea Catch Retail Attention

Markets started the week on a strong note, with benchmark indices ending higher by over 1% on Monday. The Nifty 50 closed at 24,125, while the Sensex finished at 79,408. Midcaps outperformed, registering gains of over 2.5%.

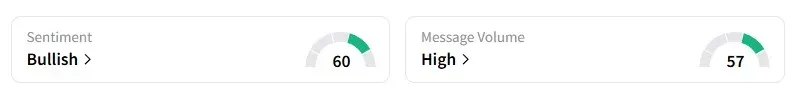

On Stocktwits, sentiment for the Nifty 50 stayed ‘Bullish.’

The Nifty Bank Index surged to a new all-time high on Monday, ending at 55,304. All constituents of the index ended in the green.

Monday’s rally was led by strong moves in PSU banks, financials, and IT stocks. Top gainers on the Nifty were Tech Mahindra, Trent, IndusInd Bank, Hero Moto, and Power Grid. The laggards include ITC, HUL, Asian Paints, Nestle India, and Adani Ports.

However, FMCG stocks remained under pressure, failing to participate in the rebound. Among individual stocks, HDFC Bank ended the session with gains of over 1%, driven by robust quarterly earnings in its fourth quarter.

Infosys also ended with gains of over 2% even as investors digested the weak earnings and cautious guidance for the new fiscal year.

Tata Elxsi's stock ended the session with a 9% gain, defying its muted fourth-quarter (Q4) earnings, as investors focused on the company's robust deal pipeline and a generous ₹75 per share dividend declaration.

Vodafone Idea gained 10% after the Government of India (GoI) increased its stake from 22.6% to 48.9% by converting a portion of the company’s spectrum payment dues into equity shares valued at ₹36,950 crore.

Suzlon also surged nearly 10% on Monday, driven by new order wins. Additionally, the Ministry of New and Renewable Energy released a draft notification mandating the local sourcing of key components used in the manufacture of wind turbine models. Brokerages believe Suzlon will benefit from this move.

SEBI-registered A&Y Market Research shared on Stocktwits that Suzlon faces a key resistance zone between ₹59.75 and ₹61. A breakout above this level could signal a trend reversal and pave the way for significant upside, A&Y Market Research said.

According to the analyst, upon breaking this resistance, the stock could target levels of ₹70, ₹78, ₹86, and potentially ₹100. The recommended stop loss is set at ₹55 to manage downside risk.

European markets are closed for trading due to Easter Monday. In the US, Dow Futures are indicating a weak start for Wall Street.

Meanwhile, U.S. Vice President JD Vance is on a four-day visit to India. During his visit, Vance will engage in discussions with Prime Minister Narendra Modi to advance negotiations on a bilateral trade agreement. The two countries aim to double their annual trade to $500 billion by 2030, a goal that, if achieved, could significantly enhance economic cooperation.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2238737789_jpg_eca1ed4bd9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)