Advertisement|Remove ads.

India Market Wrap: Nifty, Sensex Extend Gains For Sixth Session, HDFC Bank’s Market Cap Crosses ₹15 Lakh Crore

Markets ended in the green for the sixth straight session on Dalal Street. The benchmark indices ended off the day’s high, with Nifty 50 closing above 24,000, while the Sensex finished at 79,475. Midcaps outperformed, registering gains of 1%.

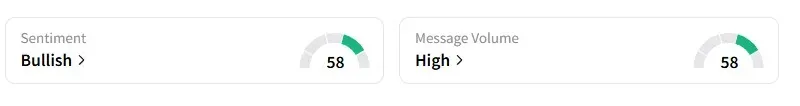

On Stocktwits, retail sentiment for the Nifty 50 stayed ‘bullish.’

Except for IT and oil & gas, all other sectors ended in the green. Realty (+2.5%) led the gains, followed by FMCG (+1.8%) and consumer durables (+1.5%). The Nifty Bank Index saw record high for second straight session.

Among individual stock movers, banking stocks such as HDFC Bank and Kotak Mahindra Bank clocked gains between 1% and 2% as the Reserve Bank of India eased Liquidity Coverage Ratio (LCR) norms. HDFC Bank’s market capitalization reached ₹15 lakh crore, making it the third Indian company to surpass this milestone.

IndusInd Bank's stock fell 5% after the bank announced the appointment of EY to conduct a second forensic audit, according to sources familiar with the matter.

The audit will investigate a ₹600 crore discrepancy in the bank's microfinance portfolio, which has raised concerns about governance. The Economic Times first reported the development on Tuesday.

Shares of Indian solar companies, including Waaree Energies and Premier Energies, experienced significant gains following a U.S. decision to impose substantial tariffs on solar panel imports from Southeast Asia.

Metals were the other focus on Tuesday. Key players, such as SAIL, gained nearly 3% on the back of the Indian government's decision to impose a 12% safeguard duty on certain steel imports.

In commodities, gold prices in India reached a historic high of ₹1.01 lakh per 10g on April 22, driven by global uncertainties, bets on Fed rate cuts, and safe-haven demand.

European markets trade mixed. In the U.S., Dow Futures are indicating a positive start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AT_and_T_store_resized_542005da9b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_barr_OG_jpg_6005cfe225.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stocks_jpg_a3427ddfd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1900667440_jpg_c3b8e52a81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1207431426_jpg_b8d7c6d852.webp)