Advertisement|Remove ads.

Nifty Reclaims 25,000 As Earnings Power Market Rebound: ICICI, HDFC Bank, Eternal Rally; Reliance Drags

Indian equity markets surged in the last hour of trade to close marginally higher on Monday, led by strong buying in Eternal, ICICI Bank and HDFC Bank on the back of strong June quarter earnings. The Nifty reclaimed its 25,000 mark.

On Monday, the Sensex closed 442 points higher at 82,200, while the Nifty 50 ended 122 points higher at 25,090. Broader markets were mixed, with the Midcap index gaining 0.7% and the Smallcap index ending flat.

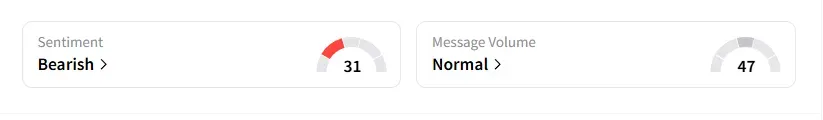

The retail investor sentiment surrounding the Nifty 50 remained ‘bearish’ by market close on Stocktwits.

Sectorally, oil & gas was the biggest laggard (-1%), followed by FMCG, PSU banks, and IT. On the other hand, metals and private banks rose by more than 1%, followed by gains in the auto, real estate, and consumer durable sectors.

Eternal was the top Nifty gainer, surging over 7%, driven by a solid show in Q1. Revenues rose 70% to ₹7,167 crore, driven by growth in Blinkit and food delivery business. Its net profit fell 90% to ₹25 crore.

Reliance was the top Nifty loser, closing 3% lower after its Q1 earnings failed to enthuse the street. ICICI Bank and HDFC Bank closed over 2% higher, driven by steady June quarter earnings.

On HDFC Bank, analyst Adarsh Nimborkar highlighted strong resistance at ₹2,020, adding that traders may witness selling pressure or profit booking near this level. Support is seen at ₹1,960 – a level that is likely to attract buying interest. Going ahead, a breakdown below this may lead to further downside, while holding above it could signal a rebound, according to him.

Other earnings movers include Mastek, which surged 7%, while AU Small Finance Bank fell 5%, Union Bank and Bandhan Bank fell over 2%.

Titagarh shares rose 1% on a fresh order win from the Indian Railways.

Globally, European markets traded mixed, while US stock futures indicate a negative start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)