Advertisement|Remove ads.

Nifty Ends Higher But Snaps 2-Week Winning Streak; Defense Stocks Rally, Broking Firms Take A Hit

Indian equity markets ended higher on Friday, with the Nifty closing below the 25,500 mark. However, the benchmarks snapped a two-week winning streak to end lower on the weekly chart.

On Friday, the Sensex closed 193 points higher at 83,432, while the Nifty 50 rose 55 points to 25,461.

Broader markets were lacklustre with the Nifty Midcap and Smallcap indices ending flat on Friday. For the week, however, they outperformed.

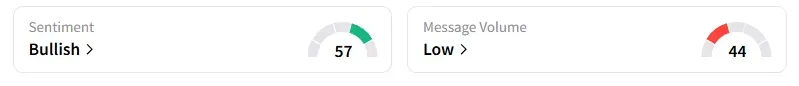

The retail investor sentiment surrounding the Nifty 50 moved back to ‘bullish’ from 'neutral' earlier in the day on Stocktwits.

On the technical front, SEBI-registered analyst Ashish Kyal noted that the Nifty index has not confirmed a downward reversal according to the three-candlestick rules, despite signs of downside drift. The prices have largely remained in a range. As the index approaches a 55-day cycle, a strong trending move may emerge. Kyal added that a breakout above 25,600 is being closely watched, although price confirmation is still awaited. On the downside, 25,300 is acting as a crucial support.

Sectorally, except for metals and auto, the rest of the indices ended in the green. The metal Index extended its fall for a second day, driven by concerns over global commodity prices.

Trent ended 11% lower after the management flagged a warning about a slowdown in growth during their annual general meeting (AGM). This led brokerage firm Nuvama to downgrade its rating and revise the target price lower for this Tata Group company.

Capital market stocks witnessed heavy selling as India’s market regulator, the Securities and Exchange Board of India’s (SEBI) ban on Jane Street and its increasingly stringent stance on the futures and options (F&O) segment weighed on sentiment. Angel One, Nuvama, Motilal Oswal, BSE, and other broking shares fell between 6% to 10%.

Defense stocks rallied after the Defence Acquisition Council (DAC) approved the purchase of military hardware worth ₹1.05 lakh crore on Thursday. Paras Defence rose 10%, while GRSE, Cochin Shipyard, DCX Systems, BEML, Astra Micro, and Mazagaon Dockyard gained between 1% to 2%.

Marico and Bajaj Finance gained 2% as the street cheered their quarterly updates.

Mahanagar Gas (MGL) and Indraprastha Gas (IGL) shares rose 3% on Friday after the Petroleum and Natural Gas Regulatory Board (PNGRB) approved amendments to the Natural Gas Pipeline Tariff Regulations, 2025, resulting in revisions to CNG and PNG prices across several cities.

Dreamfolks extended its losing streak with 13% cut on Friday. For the week, they have fallen 20% after declaring the closure of some of their loyalty programmes.

Globally, European markets traded lower. U.S. markets are shut today due to the Independence Day holiday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)