Advertisement|Remove ads.

India Market Wrap: Nifty Reclaims 25,500 In Last Hour Surge Led By Gains In Banks, Realty; US Tariffs Trigger Textile Rally

Recovery in the last hour of trade pushed the Indian benchmark indices to end near the day’s high, led by buying in banks and real estate stocks. The Nifty index reclaimed the 25,500 level.

Investors are awaiting announcements on the U.S.-India trade deal, which is expected to be made soon. This comes after US President Donald Trump imposed steep tariffs on 14 countries, including South Korea and Japan, on Monday.

The Sensex closed 270 points higher at 83,712, while the Nifty 50 ended 60 points higher at 25,522. Broader markets saw selling pressure, with the Midcap index ending 0.1% lower, and the Smallcap index falling 0.3%

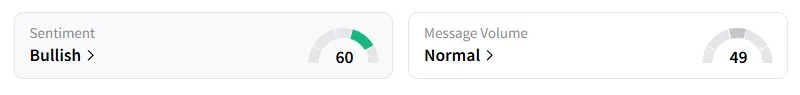

The retail investor sentiment surrounding the Nifty 50 remained ‘bullish’ on Stocktwits.

Sectorally, consumer durables and pharma, healthcare stocks witnessed selling.

Textile stocks rallied, led by Alok Industries (+10%), KPR Mill and Trident (+4%), and Gokaldas Exports (+3%). The sector may emerge stronger after the US imposed 35% tariffs on Bangladeshi garments and more duties across Asia.

Capital market stocks continued to see a selloff following SEBI’s enforcement action against U.S. trading firm Jane Street and the regulator’s intensified scrutiny of the F&O segment. BSE fell 6%, Angel One slipped 4%, while CDSL ended 2% lower.

Kotak Mahindra Bank was the top Nifty gainer, rising 3% after the bank posted a strong operational update for the first quarter (Q1 FY26), with a double-digit increase in both deposits and advances.

Titan ended nearly 6% lower, as the top Nifty loser, despite reporting a 20% growth in its first-quarter operational update, as its jewellery business growth of 18% has missed analyst estimates.

PC Jewellers ended 4% lower after the exchanges placed the stock under surveillance, given its recent sharp run. Navin Fluorine hit a fresh 52-week high, ending 3% higher after launching a Qualified Institutional Placement (QIP) to raise up to ₹750 crore.

Nectar Lifesciences ended 20% lower after the company announced its plans to sell the API and formulations businesses to Ceph Lifesciences for ₹1,270 crore.

Globally, European markets traded mixed, while US stock futures indicate a weak start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)