Advertisement|Remove ads.

Nifty, Sensex Log Biggest Weekly Jump In Four Months; Bank Nifty Scales Fresh Records

Bulls are back in control on Dalal Street. Indian equity markets gained for the third consecutive week, with the benchmarks clocking their biggest weekly gain in four months. The Nifty index reclaimed 25,700, and the Sensex inched closer to 84,000. And the Nifty Bank crossed its all-time high to set a new record high.

For the week, the benchmark indices have gained 2%.

On Friday, the Sensex closed 484 points higher at 83,952, while the Nifty 50 ended up 124 points at 25,709. Broader markets underperformed, with the Nifty Midcap index falling 0.5% and the Smallcap index ending flat.

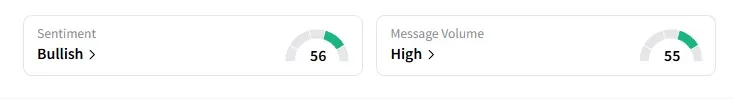

The retail investor sentiment surrounding the Nifty 50 remained ‘bullish’ by market close on Stocktwits.

Stock Moves

Sectorally, FMCG, consumer durables, pharmaceuticals, and autos led the gains. On the other hand, IT, media, and metals were the biggest losers.

Wipro (-5%) and Infosys (-2%) took a knock after its Q2 earnings failed to enthuse the street. They were the top Nifty losers on Friday.

Other earnings casualties include Polycab (-2%), Sterling and Wilson (-8%), and Waaree Energies (-3%).

Hindustan Zinc ended 2% lower after cutting guidance for refined metals and saleable silver.

Whirlpool India ended 10% higher after signing multiple long-term agreements with its US parent, securing brand and technology rights till 2029.

Yes Bank shares fell over 3% after Japanese lender Sumitomo Mitsui Banking Corporation (SMBC)said it has no immediate plans to raise its stake in the private lender beyond 24.99%.

Stock Calls

Mayank Singh Chandel flagged a breakout in Mufin Green Finance with strong momentum. Volume has also picked up, confirming buyer interest. He recommended buying above ₹98, with a stop loss below ₹90 for a target price of ₹120.

Analyst Palak Jain is bullish on HAL. A cup and handle pattern breakout is seen above resistance, confirmed by strong momentum and positive volume, indicating a fresh swing setup from the breakout. She recommended buying above ₹4,950 for target prices of ₹5,098, ₹5,247, and ₹5,544 with a stop loss at ₹4,356.

Markets: What Next?

Globally, European markets traded lower, while US stock futures indicate a weak start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)