Advertisement|Remove ads.

Nifty Ends Near 25,200 On Buying In Metals, IT & Pharma; TCS Posts Q2 Earnings Beat

Indian equity markets rebounded with the Nifty index ending near 25,200, led by buying in metals, IT, and pharmaceuticals. TCS posted an earnings beat for the September quarter post-market hours. It reported a net profit of ₹12,075 crore, while revenue from operations grew around 2% YoY to ₹65,799 crore in Q2 FY26.

On Thursday, the Sensex closed 398 points higher at 82,172, while the Nifty 50 ended up 135 points at 25,181. Broader markets outperformed, with the Nifty Midcap index rising 1% and the Smallcap index gaining 0.6%.

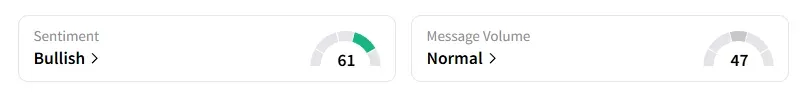

The retail investor sentiment surrounding the Nifty 50 moved from ‘neutral’ to ‘bullish’ by market close on Stocktwits.

Stock Moves

Pharma stocks saw a relief rally on reports that certain generic drugs were excluded from tariff lists. Aurobindo Pharma ended over 4% higher.

BSE shares rose 4% following reports that the regulator is expected to release a consultation paper on derivative trading rules soon.

Strong earnings performances sparked a 17% rally in GM Breweries and a 10% surge in Saatvik Green Energy.

Prestige Estates gained 5% after reporting a strong quarterly update.

Front Wave Research said that for a fresh upside, Prestige needs to deliver sequential EBITDA growth and new monetization catalysts. Along with these fundamental drivers, the stock remains in a short-term downtrend.

A breakout above ₹1,800 would confirm reversal momentum; till then, sideways consolidation persists. They advised investors to stay on the sidelines, track results, and reassess once earnings visibility improves.

Stock Calls

Mayank Singh Chandel flagged a breakout play in JK Cement. The stock has broken out of a downward trendline, showing signs of a possible trend reversal and fresh upward momentum. He recommended buying above ₹6,600, with a stop loss below ₹6,170 for a target price of around ₹7,450.

Financial Sarthis is bullish on Garuda Construction, noting a formation of flag & pole in the making. Support is seen at ₹170-₹175. On the upside, it can see a move towards ₹225 & ₹240.

Markets: What Next?

Ashish Kyal highlighted that the 25,000 level held the highest Put Open Interest (OI), which was a strong support zone, and 25,200 had the highest Call OI, acting as key resistance. A breakout above 25,220 may trigger fresh bullish momentum, while a fall below 24980 could invite short-term pressure.

Globally, European markets traded mixed, while US stock futures indicate a cautious start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)