Advertisement|Remove ads.

Indian Markets Extend Winning Streak But Nifty Fails To Hold 25,000; IT, PSU Banks Shine

Indian equity markets gained for the sixth straight session on hopes of an India-US trade deal resolution soon, but the Nifty index failed to hold the 25,000 level.

On Tuesday, the Sensex closed 323 points higher at 81,425, while the Nifty 50 ended up 104 points at 24,973. Broader markets outperformed, with the Nifty Midcap gaining 0.9% and the Nifty Smallcap index rising 0.7%.

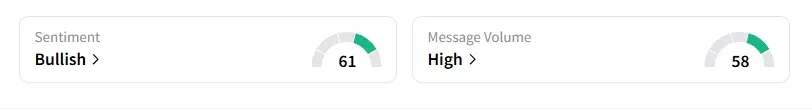

The retail investor sentiment surrounding the Nifty 50 remained ‘bullish’ by market close on Stocktwits.

Stock Moves

Sectorally, auto, media, and consumer durables saw selling pressure, while IT outperformed for the second session with 2.6% gains, followed by PSU banks (+2%).

Oracle Financial (OFSS) was the top Nifty IT gainer, surging 10% after its parent company shared an aggressive cloud business outlook. Other tech gainers include Persistent, Coforge, Mphasis, and Wipro, among others.

PSU banks rallied in trade, led by Bank of India, Union Bank, and Indian Bank, ahead of a likely meeting between the Finance Ministry and PSU bank chiefs on September 12.

Renewed trade deal optimism sparked a rally in textile stocks, with Welspun Living, Vardhman Textiles, Trident, and Alok Industries gaining between 9% and 2%.

Seafood exporters such as Apex Foods (+17%) and Avanti Feeds (+12%) surged after the European Union approved 102 new Indian fishery establishments for exports.

Vikram Solar ended 5% higher following a robust Q1 earnings report. And Cartrade Tech shares tanked 10% after JM Financial downgraded the stock to ‘sell’ on rich valuations and concerns over AI disruption.

Stock Calls

Analyst Wealth Guru recommended buying Mamata Machinery with a target price of ₹494, ₹510, and ₹550, with a stop loss at ₹470.

Dhruv Tuli flagged a breakout potential in SRF. The stock has been in a multi-year consolidation between ₹2,000 and ₹2,800 and is now showing signs of a breakout. The monthly chart structure looks bullish with RSI staying positive.

Tuli believes that a breakout above ₹2,972 can open upside targets of ₹3,150, ₹3,415, and ₹3,800, with support at ₹2,773.

Markets: What Next?

Globally, European markets traded higher, while US stock futures indicate a negative start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)