Advertisement|Remove ads.

Indian Markets At Close: Nifty Near 24,900, Sensex Rises Over 300 Points On Tech Boost

Indian equity markets ended higher for the second day, with the Nifty index ending above 24,800 in the weekly options expiry session. Technology stocks led the rally after Infosys’ potential buyback announcement sparked gains across the sector.

On Tuesday, the Sensex closed 314 points higher at 81,101, while the Nifty 50 ended up 95 points at 24,868. Broader markets mirrored the optimism, with the Nifty Midcap gaining 0.1% and the Nifty Smallcap index rising 0.3%.

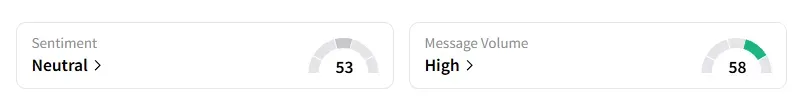

The retail investor sentiment surrounding the Nifty 50 shifted from ‘bearish’ to ‘neutral’ by market close on Stocktwits amid ‘high’ message volumes.

Stock Moves

Sectorally, energy and real estate ended in the red, while IT clocked 2.7% gains, followed by pharmaceuticals (+0.8%).

Infosys was the top Nifty gainer, rising nearly 5%, followed by Dr Reddy’s, Wipro, Adani Ports, and Tech Mahindra.

RailTel closed 6% higher on an order win from the Bihar Education Project Council.

Prime Focus hit the 10% upper circuit for the third straight session following block deals. Voltamp ended 3% lower on promoter stake sale via block deals.

Kotak Mahindra Bank recovered to end in the green after reports indicated that Japanese lender Sumitomo Mitsui Banking Corporation (SMBC) is expected to offload its entire 1.65% stake through block deals.

Markets: What Next?

Globally, European markets traded mixed, while US stock futures indicate a subdued start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)