Advertisement|Remove ads.

India Market Wrap: Nifty Ends Below 25,400 Ahead Of TCS Results; PSU Banks, IT, Pharma Drag

Indian equity markets ended lower in a choppy expiry session on Thursday, with the Nifty ending below 25,400, led by declines in IT, PSU banks, and pharmaceutical stocks.

Investors await developments on the US-India trade deal, as well as monitor Tata Consultancy Services (TCS) earnings scheduled for today.

The Sensex closed 345 points lower at 83,190, while the Nifty 50 ended 120 points lower at 25,355. Broader markets mirrored the weakness, with the Midcap index and the Smallcap indices falling 0.3%.

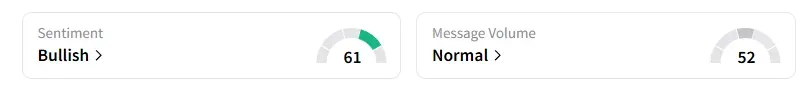

The retail investor sentiment surrounding the Nifty 50 has moved back to ‘bullish’ on Stocktwits.

Sectorally, barring metals and real estate stocks, the r̥est of the indices ended in the red.

Glenmark Pharma surged 5% to hit a fresh 52-week high.

AMC stocks, such as UTI AMC (+3%), Aditya Birla Sun Life (+4%), and Nippon Life, HDFC AMC (+1%), gained on positive June AMFI data.

In other stock movers, Enviro Infra ended 2% higher after securing a mega order from MIDC. GP Eco Solutions surged 5% after winning a ₹121 crore contract for the execution of a solar power project.

Globally, European markets traded higher, while US stock futures indicate a positive start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_92efa5a8c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Visa_resized_82d951e81e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1218279776_jpg_d381694a09.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199360480_jpg_41abd97106.webp)