Advertisement|Remove ads.

India Market Wrap: Nifty Ends Below 25,100 As Tech Stocks Stumble; Midcaps And Smallcaps Buck The Trend

Indian equity markets ended lower on Monday, dragged by selling in technology after the weak earnings performance in TCS last week. Investors will be eyeing HCL Technology earnings fineprint due today.

On Monday, the Sensex closed 247 points lower at 82,253, while the Nifty 50 ended 67 points lower at 25,082. Broader markets outperformed, with the Midcap index rising 0.7% and the Smallcap indices gaining over 1%.

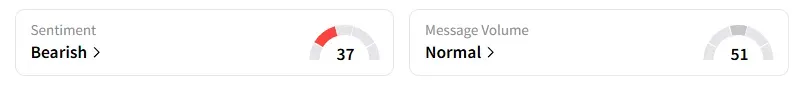

The retail investor sentiment surrounding the Nifty 50 remained ‘bearish’ on Stocktwits.

Sectorally, IT was the biggest loser, ending over 1% lower. On the other hand, media, real estate, pharmaceuticals, and consumer durables saw significant gains.

Ola Electric shares extend gains to 16% despite reporting a wider loss in Q1 as its auto business made an operating profit in June. The company also shared aggressive guidance for FY26.

However, analyst Mayank Singh Chandel noted that the stock is in a clear downtrend on the charts and does not appear strong fundamentally either. He advised staying away from this stock for now and waiting for signs of improvement.

VIP ended 5% higher even after promoters sold a 32% stake in the company to multiple buyers.

Strong volume movers include Eternal, Glenmark, JP Power, and Vishal Mega Mart.

Neuland Laboratories shares surged 20% ahead of the final dividend. Ahluwalia Contracts ended 5% higher after securing a ₹2,089 crore order from DLF. Castrol shares finished 2% higher after favourable order on ₹4,131 crore tax dispute.

Globally, European markets traded mixed on Trump's new tariff threats on the EU and Mexico, while US stock futures indicate a negative start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)