Advertisement|Remove ads.

Nifty Ends Below 25,500 As Caution Prevails Ahead Of US Tariff Deadline

Indian equity markets reversed early gains to end lower as investors remained cautious ahead of the crucial US trade tariff deadline on July 9. The Nifty index slipped below the crucial 25,500 mark.

The Sensex closed 287 points lower at 83,409, while the Nifty 50 closed 88 points lower at 25,453.

Broader markets too mirrored the bearish sentiment, with the Nifty Midcap index ending 0.1% lower and the Smallcap index falling 0.4%.

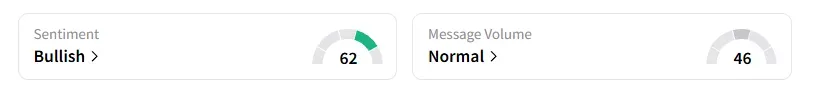

The retail investor sentiment surrounding the Nifty 50 remained ‘bullish’ on Stocktwits.

Sectorally, the metals index rallied nearly 1.5% in a weak market, tracking positive global cues. Tata Steel and SAIL rose over 3%, JSW Steel and Jindal Steel ended 2% higher.

Among other sectoral gainers, consumer durables and auto stocks witness some buying. On the flip side, real estate stocks fell for fifth straight session, followed by weakness in PSU and private banks.

Asian Paints ended 2% higher, shrugging off concerns over the Competition Commission of India's probe into allegations of market dominance abuse.

IndusInd Bank ended 3% lower after Goldman Sachs downgraded it to ‘Sell’ with a target price of ₹722 per share.

Tata Communications surged 5% after Macquarie initiated an 'outperform' rating, adding that the stock could double over the next three years in a bullish scenario.

Inox Wind gained 3% after Motilal Oswal initiated a ‘Buy’ call, with a target price of ₹210, implying 21% upside.

RITES rallied 6% after the company secured two mega orders in Africa and India. Keystone Realtors (Rustomjee) rose 3% after winning a ₹3,000 cr redevelopment project in Mumbai.

HDB Financial Services made a stellar debut, listing at a 13% premium and ended with similar gains. And Gabriel India shares continued their strong run, hitting a 52-week high on the restructuring plan.

On the technical front, SEBI-registered analyst Ashish Kyal noted that after breaking 25,460, the Nifty index tested 25,380, before reversing from there. Despite this, the prices have not confirmed a downward reversal yet, according to the three-candlestick rule, since the current high remained above its previous high, even though the close was below its prior low.

Kyal sees a near-term trading range between 25,600 and 25,350 for the Nifty.

Globally, European markets traded higher, and Dow Futures indicated a positive opening for Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)