Advertisement|Remove ads.

Nifty Breaches 24,700 On Kotak Bank, Real Estate Rout; SEBI RAs Flag Deeper Correction Risks

Indian equity markets ended near a two-month low, with the Nifty index closing below 24,700, driven by the selloff in Kotak Bank and real estate stocks.

On Monday, the Sensex closed 572 points lower at 80,891, while the Nifty 50 ended 156 points lower at 24,680. Broader markets saw deeper cuts, with the Nifty Midcap index falling 0.8% and the Smallcap index declining 1.2%.

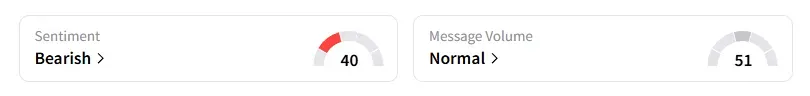

The retail investor sentiment surrounding the Nifty 50 remained ‘bearish’ by market close on Stocktwits.

Stock Moves

Sectorally, barring pharma and FMCG, rest of the indices ended in the red, led by selling pressure in real estate (-4%), media (-3%), and metals (-1%).

Kotak Mahindra Bank was the top Nifty loser, ending over 7% lower after its June quarter earnings and management commentary spooked the street. IndusInd Bank finished 3% lower ahead of earnings

Meanwhile, Shriram Finance ended 3% higher as the top Nifty gainer on the back of strong earnings. The management retained their 15% loan growth target for FY26.

In other earnings movers, CDSL ended 6% lower. Analyst Sunil Kotak noted that the trend is bearish on its daily chart and more pain is possible from here. He identified support between ₹1,380 and ₹1,420.

Markets: What Next?

Ashish Kyal said that the Nifty has been failing to close above the previous day's high, keeping the tone on the sell side. Call option sellers at the 25,000 strike are showing aggressive activity, with the next significant short positions emerging at the 24,800 strike. He advised avoiding buying unless the index breaks above the 24,800 level. The key support level is now identified at 24,470.

Analyst Saurab Jain added that Nifty is consistently forming lower highs and is now hovering near the critical 24,700 support level. A breakdown below this could weaken short-term sentiment and open the door for a deeper correction to the 24,300–24,150 zones. On the other hand, if 24,700 holds, we may see a relief rally toward 25,200.

On the macro front, India's Manufacturing PMI data is due on August 1. This will provide the first indication of demand momentum and industrial recovery heading into the second quarter, Jain said.

Globally, European markets traded higher as investors welcomed the 15% tariff deal with the US. Meanwhile, US stock futures indicate a positive start on Wall Street ahead of trade talks with China.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)