Advertisement|Remove ads.

Nifty Ends Below 24,800 As Tariff Shock Weighs On Sentiment; Pharma, Textiles & Autos Take A Knock

Indian equity markets failed to hold the intra-day recovery and ended the weekly expiry session on a weak note on Thursday. The Nifty index ended below the 24,800 level after US President Donald Trump imposed 25% tariffs overnight on India.

However, he did go on to state later that trade negotiations with India would continue. Indian officials have indicated that the next round of talks is scheduled for early August.

On Thursday, the Sensex closed 296 points lower at 81,185, while the Nifty 50 ended 86 points lower at 24,768. Broader markets underperformed, with the Nifty Midcap and Smallcap indices ending 1% lower.

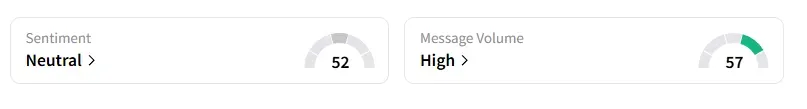

And the retail investor sentiment surrounding the Nifty 50 settled back at ‘neutral’ by market close on Stocktwits.

Stock Moves

Sectorally, barring FMCG (1.4%) and media (0.1%), the rest of the sectors ended in the red. Energy (-1.4%), pharma (-1.3%), and metals (-1.2%) were the biggest laggards.

Tariff shock sparked losses across textiles (Welspun, Trident, KPR Mills, Gokaldas fell between 2% to 5%), pharmaceuticals (Lupin declined 2%, Cipla fell 3%), and auto components (Motherson Sumi & Bharat Forge fell 2%).

Hindustan Unilever was the top Nifty gainer (+3.5%), driven by steady earnings growth, followed by Jio Financial (+3%) on the back of its fundraising plans.

A slew of earnings reports came in during the last hour of trade: Ambuja Cement (-4.5%), Adani Enterprises (-4%), Sun Pharma (-2%), Maruti Suzuki (-0.8%). On the other hand Dabur gained over 1%.

Other notable earnings movers include Emami (+6%), HEG (+7%) and Kaynes Tech, Sagility (+10%).

Markets: What Next?

Analyst Ashish Kyal noted that the Nifty index is back to magnet Gann levels of 24,728. He anticipates the market to consolidate between 24,660 and 24,890 over the next 1-2 days before seeing a directional move again. Thursday’s low near 24,630 has been identified as a crucial support.

https://stocktwits.com/kyalashish/message/623163466

Globally, European markets traded mixed, while US stock futures indicate a weak start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_amazon_walmart_jpg_05c61e928f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2217651413_jpg_838cf7a8bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_walmart_OG_jpg_8a74984dc4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347001_jpg_8286032c70.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)