Advertisement|Remove ads.

Nifty Tops 25,200 Amid Bullish Sentiment; IT Stocks Drag After TCS, Tata Elxsi Earnings

Indian equity markets opened on a firm note, with the Nifty inching above 25,200 in early trade. Sectorally, barring IT and metals, the rest of the indices traded in the green, led by real estate and PSU banks.

At 09:50 a.m. IST, the Nifty 50 traded 95 points higher at 25,277, while the Sensex was up 345 points at 82,547. Broader markets mirrored the optimism, with the Nifty Midcap index rising 0.3%, and the Smallcap index gaining 0.6%.

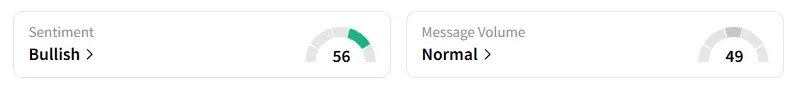

The retail sentiment on Stocktwits for the Nifty was ‘bullish’ at market open.

Stock Watch

TCS shares fell 1% despite India’s largest IT services provider reporting a steady September quarter (Q2) earnings.

Tata Elxsi shares fell over 2% after a 32% drop in Q2 profits. On the other hand, 5Paisa Capital surged 10% despite posting a 56.7% drop in Q2 profit.

Subex shares rose 10% after the company secured a six-year, ₹54.95 crore contract from a Dutch telecom operator. RailTel gained over 1% on securing a new ₹18 crore order.

Natco Pharma rose 4% on winning a legal battle against Roche, clearing the way to launch a generic version of ‘Risdiplam’.

And MIRC Electronics rose 5% as Authum Investment raised its stake to 21.25% in the company.

Stock Calls

Analyst Vinayak Gautam shared three stock recommendations for Friday with a 1-week timeframe:

Afcons: Buy at ₹465, with a target price of ₹495, for a stop loss at ₹450

Railtel: Buy at ₹383, with a target price of ₹405, for a stop loss at ₹375

Adani Enterprises: Buy at ₹2,542, with a target price of ₹2,620, for a stop loss at ₹2,501

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Varunkumar Patel noted that Foreign Institutional Investors (FIIs) turned strong buyers with ₹1,300+ crore inflows in cash, while in F&O they significantly reduced their net index call shorts, indicating a shift toward a more positive outlook. Sentiment remains bullish, but Patel maintains a “wait and watch” stance. He advised traders to avoid aggressive longs until the earnings season unfolds and confirms the trend.

Sunil Kotak noted that Nifty’s Relative Strength Index (RSI) remained above 60, with continued FII buying on Thursday. He sees Nifty support at 25,000 with resistance at 25,250.

Global Cues

Globally, Asian markets traded broadly weak, while crude oil prices continue to ease, providing support to global equity markets. After several strong sessions, gold and silver faced a notable correction.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)