Advertisement|Remove ads.

Indian Markets Open Firm On Expiry Day; Auto, Metals, Energy Lead Gains

Indian equity markets opened on a cautious note as it headed into the weekly options expiry session, with the Nifty hovering around the 25,100 level.

At 09:45 a.m. IST, the Nifty 50 traded 62 points higher at 25,131, while the Sensex was up 237 points at 82,023. Broader markets mirrored the gains, with the Nifty Midcap index rising 0.2% and the Smallcap index trading 0.6% higher.

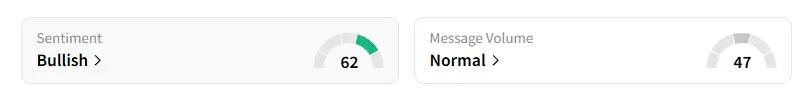

The retail sentiment on Stocktwits for Nifty has remained ‘bullish’ at market open.

Stock Watch

Sectorally, barring mild weakness in the FMCG sector, the rest of the indices traded in the green, led by the auto, energy, and metals sectors.

Adani Enterprises gained 1% on receiving a letter of agreement from NHLML for a ₹4,081 crore ropeway project.

NCC gained nearly 3% on securing a ₹2,090.5 crore contract from Bihar’s Water Resources Department.

Sanghvi Movers rose 2% after its subsidiary bagged renewable energy orders worth ₹292 crore.

Stock Calls

Analyst Vinayak Gautam shared three stock recommendations for Tuesday with a 1-week timeframe:

CreditAccess Grameen: Buy at ₹1,322 for a target price of ₹1,340, and a stop loss at ₹1,310

Manappuram: Buy at ₹291 for a target price of ₹305, a stop loss at ₹287

Gabriel India: Buy at ₹1,302 for a target price of ₹1,350, a stop loss at ₹1280

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Vinay Taparia said Nifty is trading near a crucial resistance zone. Any move beyond 25,150 can trigger sharp short covering, with 24,950-25,000 acting as a good support. However, a close below 25,000 could lead to a decline to the 24,800-24,850 levels. He expects the markets to be rangebound between 24,950 and 25,150.

SEBI-registered investment advisor Nidhi Saxena of Trade Bond noted that market volatility may spike nearer to the Fed decision.

Global Cues

Globally, Asian markets traded mixed, while crude oil prices held steady. Investors will be watching the outcome of the two-day US Federal Reserve meeting that begins today.

For updates and corrections, email newsroom[at]stocktwits[dot]co

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208385583_jpg_9511ec9642.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229273911_jpg_6b4851e2cc.webp)