Advertisement|Remove ads.

Nifty Slips Below 25,100, Retail Sentiment Turns 'Extremely Bearish'; Axis Bank Drags, Wipro Gains On Q1 Earnings

Indian equity markets opened lower on Friday, remaining in consolidation mode, with the Nifty index slipping below crucial support levels.

At 09:50 a.m. IST, the Nifty 50 traded 67 points lower at 25,043, while the Sensex was down 257 points at 82,001. Broader markets traded flat with a positive bias.

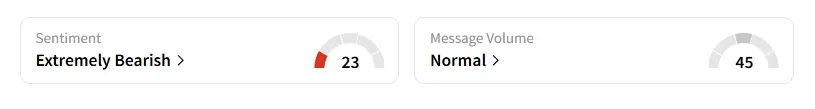

Meanwhile, the retail sentiment on Stocktwits for Nifty has moved back to ‘extremely bearish’ from ‘bearish’ after markets opened.

Sectorally, metals, auto, and real estate continue to gain, while FMCG and private banks witnessed selling pressure.

Wipro is the top Nifty gainer, rising over 3% even as it reported a mixed first-quarter (Q1) earnings fineprint. Morgan Stanley raised its target price to ₹285, indicating a 10% upside, citing their steady Q2 guidance. Strong deal wins and better capital allocation are expected to aid H2 growth, according to them.

Axis Bank is the top Nifty loser, cracking over 4% after its Q1 earnings disappointed, with asset quality concerns due to a classification change weighing on investor sentiment.

LTIMindtree fell 2% despite reporting a 10.6% increase in profit, but its EBIT margin declined to 14.3%. Shoppers Stop fell 5% despite its quarterly loss narrowing to ₹15.74 crore, while revenue grew 8.6%.

Watch out for RIL, JSW Steel, Bandhan Bank, Aarti Drugs, Atul, Hindustan Zinc, IndiaMART, among others, as they report quarterly earnings today.

Investors will also be watching for HDFC Bank, ICICI Bank, Union Bank of India, RBL Bank, Yes Bank, AU Small Finance Bank, Reliance Power, and others, that report earnings on July 19.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Ashish Kyal highlighted that the Nifty index has continued to move in a lacklustre range, with prices near the lower end of the range again. A 15-minute close above 25,210 can result in a retest of 25,270 or higher levels, whereas a close below 25,080 is expected to trigger selling pressure, potentially leading to a move to 25,020 - 24,980. The trading range is likely to remain narrow for the time being.

Analyst Varunkumar Patel noted that Foreign Institutional Investors have offloaded over ₹3,600 crore in cash market stocks and have built fresh net short positions in index futures, with their overall F&O position reaching a new high since March 2025. This suggests a bearish outlook from FIIs.

The ongoing result season has underperformed market expectations, particularly in the banking sector, which is weighing on sentiment. Patel said the market is likely to trend downward from here. However, select mid- and small-cap stocks and sectors continue to perform well. A bottom-up approach, with a focus on careful stock selection, is crucial. His advice remains to focus on high-quality delivery-based stocks with tight stop-losses.

Prabhat Mittal pegged Nifty support at 24,980 and resistance at 25,220. For the Bank Nifty, he sees support at 56,600 and resistance at 57,200.

Globally, Asian markets traded higher, while crude oil prices remained largely unchanged, as concerns about demand persisted due to the attacks on Iraq's oil fields.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)