Advertisement|Remove ads.

Indian Markets Rangebound, Nifty Tests 25,600; Wipro, Infosys Lead IT Sell-off

Indian equity markets opened lower but saw signs of recovery in the first 15 minutes of trade. The Nifty index tested 25,600, while Sensex held the 83,000 levels. Technology was the top loser, followed by media and PSU banks. On the other hand, autos, FMCG, and consumer durables bucked the trend.

At 09:50 a.m. IST, the Nifty 50 was flat at 25,582, while the Sensex was up 37 points at 83,505. Broader markets were mixed, with the Nifty Midcap index declining 0.1%, and the Smallcap index gaining 0.3%.

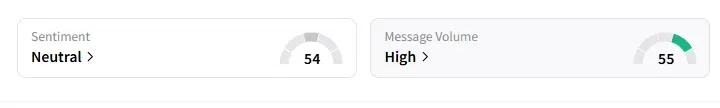

The retail sentiment on Stocktwits for the Nifty has moved from ‘bullish’ to ‘neutral’ at market open amid ‘high’ message volumes.

Stock Watch

Wipro shares fell nearly 5% and Infosys was down almost 2% as the street was not enthused by its September quarter (Q2 FY26) earnings performance.

Eternal shares extended losses as a slow recovery in the food NOV remained an overhang in its Q2 earnings.

Other earnings casualties included Zee Entertainment (-3%) and Jio Financial (-1%).

Reliance Industries held steady ahead of its Q2 report later today.

Share India shares surged 10% after its board approved a significant ₹50 crore NCD issue for business development.

Welspun Living fell by over 3% on reports of a promoter stake sale via block deals at a discount.

Stock Calls

Analyst Vinayak Gautam shared three stock recommendations for Friday with a 1-week timeframe:

Wipro: Buy at ₹253, with target price of ₹276, and stop loss at ₹243

Crizac: Buy at ₹289, with target price of ₹295, and stop loss at ₹286

Infosys: Buy at ₹1,471, with target price of ₹1,520, and stop loss at ₹1,447

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Prabhat Mittal identified Nifty support at 25,450 with resistance at 25,720 and 25,820. For Bank Nifty, he sees support at 57,100 and resistance at 58,000.

Varunkumar Patel highlighted that after several days, FIIs have turned positive across all segments. Additional support comes from a potential US-India trade pact announcement on Diwali. He added that corporate earnings, especially from the IT sector, have not fully supported the rally as results are below market expectations. Hence, fundamentals aren’t the main driver.

According to Patel, the overall global sentiment remains neutral to negative, but the Indian market is outperforming peers. He advised traders to focus on quality stocks, trade carefully, and always use stop losses.

Global Cues

Globally, Asian markets traded lower, while crude oil prices are headed for a third weekly decline. US President Donald Trump announced that he will meet Russian President Vladimir Putin in Budapest to work toward ending the “inglorious” Ukraine war, following what he called a “very productive” phone conversation.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)