Advertisement|Remove ads.

Nifty Holds 24,800 In Weekly Expiry Session; Infosys Buyback Buzz Lifts Tech, Auto Slips

Positive start for Indian equity markets, with the benchmark indices extending the gains at open. The Nifty index moved past the 24,800 level in the weekly options expiry session.

At 09:45 a.m. IST, the Nifty 50 traded 73 points higher at 24,846, while the Sensex was up 279 points at 81,066. Broader markets mirrored the optimism, with the Nifty Midcap and Smallcap indices trading 0.1% higher.

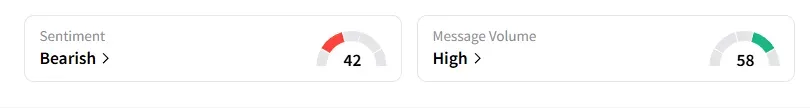

However, the retail sentiment on Stocktwits for Nifty remained ‘bearish’ at market open.

Stock Watch

Sectorally, autos and consumer durables saw some selling pressure. On the other hand, technology outperformed with 2% gains.

Infosys was the top Nifty gainer, rising 4% after the board announced a meeting on September 11 to mull a buyback proposal.

Auto stocks saw some profit booking even as Morgan Stanley turned bullish on the sector, upgrading Eicher Motors and Hero Motocorp.

Voltamp Transformers fell 3% following a large block deal that saw its promoters reportedly selling 7% stake.

Railtel shares surged 5% on an order win.

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Pradeep Carpenter cautioned that the weekly options expiry for Nifty on Tuesday could drive volatility. A break above 24,948 could trigger short covering, while support holds firm near 24,700.

For Bank Nifty, support is seen between 54,000–53,800, with resistance at 54,300–54,600. And for Sensex, support is seen between 80,600–80,400, with resistance at 81,000–81,300.

Varunkumar Patel noted that Foreign Institutional Investors (FIIs) sold ₹2,100 crore in cash. In F&O, there was no change in net index shorts but a big shift as they reduced heavy index call shorts and turned into net call buyers. In sectoral picks, he noted that the auto sector appears strong, particularly mid-cap auto ancillaries, where selective opportunities exist. Patel advised traders to ride the auto wave, but maintain a stop-loss in place to protect gains.

A&Y Market Research identified intraday Nifty resistance at 25,009 - 25,075, with support at 24,738 - 24,800. For Bank Nifty, resistance is seen at 54,492 - 54,587, and support at 54,177 - 54,248

Global Cues

Globally, Asian markets traded mixed, while crude oil prices held steady after Saudi Arabia cut pricing for most of its grades.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)