Advertisement|Remove ads.

Nifty Hovers Near 25,000; RIL Drags, ICICI, HDFC Bank Gain On Earnings

Indian equity markets opened on a subdued note on Monday, with the Nifty index hovering around the 25,000 mark. Mixed earnings from index heavyweights weighed on investor sentiment, even as they continue to monitor developments on a potential trade deal with the US ahead of the August 1 deadline.

At 09:50 a.m. IST, the Nifty 50 traded 41 points higher at 25,009, while the Sensex was up 183 points at 81,941. Broader markets traded flat.

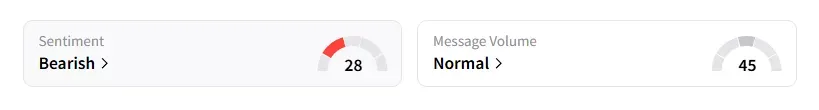

Meanwhile, the retail sentiment on Stocktwits for Nifty remained ‘bearish’.

Sectorally, most indices traded in the red, led by IT, oil & gas (-0.8%), PSU banks, and pharma (-0.6%). On the other hand, metals rose 0.6%.

Reliance (RIL) shares fell 2% as the street reacted to its earnings for the June quarter. Profits rose 76% (including a one-time gain from Asian Paints stake sale), driven by Jio and retail platforms, while its oil-to-chemicals (O2C) earnings came in below estimates.

ICICI Bank rose 1%, driven by a strong show in first quarter (Q1 FY26) earnings. HDFC Bank shares rose by over 1% after its Q1 earnings came in line with estimates. The bank declared a 1:1 bonus issue and a ₹5 special dividend.

Axis Bank continues to sell off, falling nearly 2% on concerns over its change in internal NPA classification norms. And IndusInd Bank fell over 3% ahead of its board meeting this week to mull fundraising plans and its earnings performance.

Bandhan Bank fell 2% as concerns over higher write-offs and asset quality weighed on investor sentiment. The stock is also placed under the F&O ban.

Sona BLW rose 3% after signing an agreement with China-based Jinnaite Machinery to establish a joint venture targeting the Chinese electric vehicle (EV) market. Dr Reddy’s fell 1% after its Srikakulam facility received seven observations from the US FDA. While IRCON surged 3% on the back of multiple order wins.

Watch out for Eternal, UltraTech Cement, Havells, IDBI Bank, Mahindra Logistics, Oberoi Realty, Parag Milk Foods, PNB Housing Finance, and UCO Bank, among others, as they report quarterly earnings today.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Ashish Kyal noted that a 15-minute close above 25,020 could result in a short-term pullback to 25,080-25,140 levels. Any breach below 24,900 would lead to the index continuing its downtrend to 24,830 or lower. He sees the markets trade in a range between 25,900-25,080 for now.

Prabhat Mittal pegged Nifty support at 24,880, 24,780, and resistance at 25,120. For the Bank Nifty, he sees support at 56,700 and resistance at 56,600.

A&Y Market Research identified intraday Nifty resistance between 25,009 - 25,075, and support at 24,738 - 24,800. For Bank Nifty, they peg resistance at 56,467 - 56,510 and support at 56,030 - 56,102.

Globally, Asian markets traded mixed, while crude oil prices held steady as investors watched for the impact of new European sanctions on Russian oil and concerns about tariffs affecting global growth.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)