Advertisement|Remove ads.

Indian Markets Open Weak After Six-Day Rally, Nifty Slips Below 25,000; Financials, Metals Drag

Indian equity markets opened weak on Friday, with the Nifty slipping below 25,000. The markets could snap a six-session winning streak if the weakness persists through the day.

At 09:40 a.m. IST, the Nifty 50 traded 118 points lower at 24,965, while the Sensex was down 362 points at 81,637. Broader markets also mirrored the market sentiment, with the Nifty Midcap index trading flat and the Smallcap Index trading 0.3% lower.

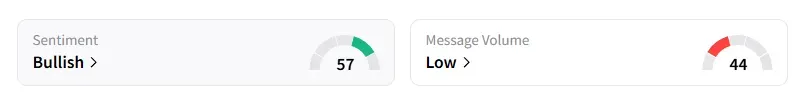

However, the retail sentiment on Stocktwits for Nifty remained ‘bullish’ at market open.

Stock Watch

Sectorally, barring consumer durables, media, and select pharmaceuticals, the rest of the indices traded in the red. Financials, metals, and real estate saw the most selling pressure.

Divi’s Labs gained 2% on a positive brokerage note. Citi called its recent weakness a buying opportunity with a target price of ₹7,750, indicating 28% upside.

Wipro traded flat following news of its acquisition of Harman’s Digital Transformation Solutions business for ₹3,200 cr. And HUL traded marginally lower after appointing a new CFO.

NTPC Green Energy gained nearly 1% as its subsidiary made solar capacity operational in Gujarat.

Texmaco Rail gained over 2% on securing orders over ₹100 cr. Titagrah rose 1% on a ₹467 cr order win from GRSE.

R Systems surged 12% after buying Novigo Solutions for ₹400 crore.

Stock Calls

Analyst Vinay Taparia said that Vesuvius India has started moving higher from its support zone, and its Relative Strength Index (RSI) has given a breakout. The stock can move to ₹580-₹620 levels in the next six to nine months, with ₹510 acting as a good support. But a close below ₹499 negates this view.

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Ashish Kyal highlighted that if the Nifty index moves towards 25,040 and forms a reversal on the 5-minute Ichimoku cloud, scalp for a move to 25,160 or higher. He advised positional traders to continue riding with 24,970 as immediate support. A buy on dips is a better strategy than buy above in the current context, Kyal noted.

Prabhat Mittal identified Nifty support at 24,850, with resistance at 25,150. For the Bank Nifty, he sees support at 55,300 with resistance at 56,100.

Global Cues

Globally, Asian markets traded mixed, while crude oil prices held ground as hopes for immediate peace between Russia and Ukraine dimmed.

Investors will be watching the US Federal Reserve Chairperson Jerome Powell’s Jackson Hole speech, which may set the tone for global risk sentiment.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)