Advertisement|Remove ads.

India Markets Weak In Early Trade As Global Jitters Offset GDP Cheer; Nifty Slips Below 24,600

Indian markets opened lower on Monday, with a sharp selloff in Nifty and Sensex despite upbeat GDP data of 7.4% in the fourth quarter (Q4). US President Trump’s tariff actions and rising geopolitical concerns weigh on investor sentiment.

Meanwhile, markets are pricing in a 25 basis points rate cut by the Reserve Bank of India in their monetary policy meeting later this week.

At 9:45 a.m. IST, the Nifty 50 had fallen 159 points to 24,591, while the Sensex was down 592 points to 80,858.

Broader markets outperformed with the Nifty Midcap and Smallcap indices gaining 0.2%

Meanwhile, the India Volatility Index (VIX), a key gauge of market fear, surged 4%.

Analysts believe a decisive breakout is likely on the Nifty 50 index this week.

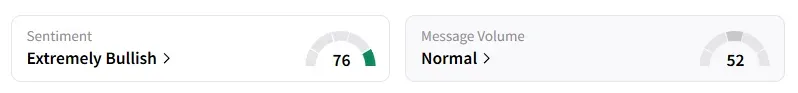

However, the retail sentiment on Stocktwits remained ‘ extremely bullish’.

Sectorally, technology is the biggest laggard, down 1.25%, followed by metals, which is down nearly 1%.

Hindalco, JSW Steel, Tata Steel fell between 1% and 2% as the U.S. doubled steel tariffs to 50%

Auto stocks reacted to May sales data. Tata Motors fell 1% after the sales came in below estimates, while M&M gained nearly 1% after vehicle sales rose 17% in May. TVS Motor fell 1% despite a growth surprise.

Apollo Hospitals is the top Nifty gainer, rising 3%, driven by strong March-quarter earnings. Citi maintains a ‘Buy’ rating with a target price of ₹8,260, indicating a 20% upside.

HUL traded 1% higher after the Indian government slashed the customs duty on edible oil by 10%

Vodafone Idea traded nearly 1% higher after its losses narrowed in the fourth quarter. UBS maintains a ‘Buy’ call with a target of ₹12.10, expecting 75% upside.

IRCON shares rose nearly 2% after the company bagged ₹1,068 crore EPC contract for the mega Ganga rail bridge.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Prabhat Mittal pegged immediate support for the Nifty at 24,650 and resistance at 24,950, while he placed Bank Nifty support at 55,400 and resistance at 56,200.

A&Y Market Research expects continued selling pressure from foreign institutional investors (FIIs) to weigh on the overall market mood. They peg Nifty resistance between 24,746 and 24,811 and support at 24,455-24,507.

For Bank Nifty, they see intraday resistance at 55,930-56,050 and support between 55,443-55,557.

Asian markets traded mixed as tariff tantrums, tax uncertainty, and the widening conflict between Ukraine and Russia spooked investors.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)