Advertisement|Remove ads.

Nike Stock Falls After Investor Update and Analyst Downgrade: Retail’s Extremely Bullish

Shares of Nike ($NKW) fell 4.27% on Friday as Citi revised down their ratings or price targets following an investor update from its new leadership about the company's strategic direction, but retail sentiment improved.

Citi downgraded Nike to ‘Neutral’ from ‘Buy’ with a price target of $72, down from $102, after the company's new CEO Elliott Hill held an investor update about its ongoing turnaround, fly.com reported.

According to the firm, fiscal 2026 may not change the way it had anticipated on sales or EBIT margin line and it didn’t have "the patience or conviction to wait another year," said the report. Citi believes fiscal 2026 consensus estimates may be too high, making Nike's turnaround timing "much less visible," added the report. Additionally, its revenue pressures may linger in fiscal 2026, without enough product moves at scale to "fill the void."

Deutsche Bank also lowered its price target to $77 from $84 with a ‘Buy’ rating. According to the firm, Nike's turnaround will take time along with pressures with franchise management that could impact the company's near-term performance. The firm estimates it will more time to rebuild Nike's earnings per shared base back above $3.00.

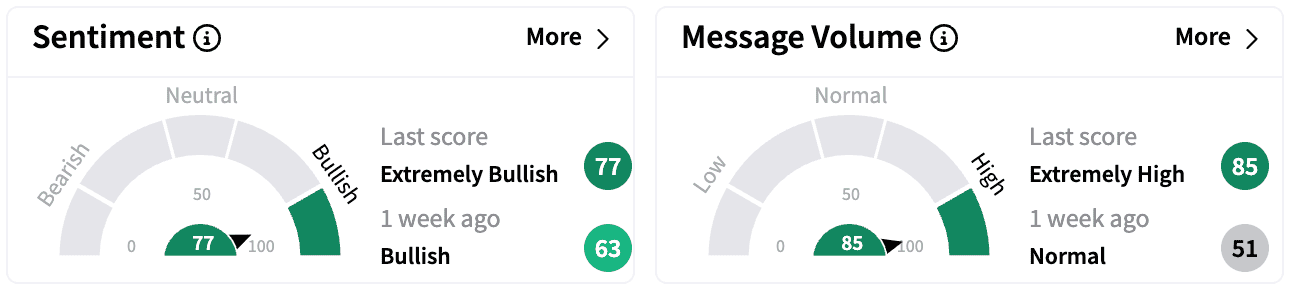

Sentiment on Stocktwits turned ‘extremely bullish’ from ‘bullish’ from a week ago. Message volumes increased to ‘extremely high.’

The Nike investor meeting reportedly covered the company's turnaround strategy and outlined the strategic efforts towards strengthening its wholesale relationships, product measures and inventory resizing.

Barclays was also reported as noting that Nike’s "culture reset" will take time to result into financial recovery, Investing.com reported.

Nike stock is down 9.2% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_duolingo_resized_jpg_b62f52b726.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_purple_jpg_faad1be151.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259270325_jpg_4fbb248789.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298117_jpg_2f7ddb9196.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Ram_83262cba1d.jpg)