Advertisement|Remove ads.

Nike Stock Tumbles Nearly 6% After Hours Despite Q2 Beat As Tariffs Drag Down Direct Sales And Converse

- Profitability was hit by higher tariffs and costs, even as revenue edged higher.

- Growth in wholesale channels failed to fully offset declines in digital and brand-owned stores.

- The company said it remains focused on repositioning the business for long-term recovery.

Nike shares slipped nearly 6% in after-hours trading on Thursday after the company posted second-quarter (Q2) results that beat Wall Street expectations but highlighted ongoing pressure on margins, direct-to-consumer sales and the Converse brand.

The sportswear maker said earnings per share for the quarter came in at $0.53, beating analyst estimates of $0.37, while revenue rose 1% to $12.4 billion, slightly above consensus expectations of $12.21 billion.

Tariffs Weigh On Margins, Profits Fall

Gross margin declined 300 basis points to 40.6%, mainly due to the impact of higher tariffs in North America, the company said. Net income decreased 32% to $800 million, due to margin pressure and higher costs, despite an increase in revenue.

Selling and administrative expenses increased 1% to $4.0 billion, while demand creation spending jumped 13% on higher brand and sports marketing costs. Operating overhead declined 4%, helped by lower wage-related and administrative expenses.

Wholesale Strength Can’t Offset Weak Direct Sales

Nike Brand revenue climbed 1% to $12.1 billion, helped by strength in North America, but was partially offset by weakness in Greater China and Asia Pacific & Latin America.

Wholesale revenue grew 8% to $7.5 billion, while Nike Direct revenue declined 8% to $4.6 billion, impacted by a 14% decrease in digital sales and a 3% dip at Nike-owned stores.

Converse continued to underperform, with revenue down 30% to $300 million, as sales dropped in all regions.

Inventories Ease, Cash Balance Declines

Inventories decreased 3% to $7.7 billion as lower unit inventories were partially offset by higher unit costs, primarily due to the impact of tariffs.

Cash and short-term investments fell by about $1.4 billion to $8.3 billion, as the $3.1 billion generated from operations was outweighed by dividend payments, debt repayments, share buybacks and capital spending.

Nike paid nearly $598 million in dividends to shareholders during the quarter, up 7% from the prior year. This is the 24th consecutive year that Nike has increased its dividend.

Management Sticks With Turnaround Message

CEO Elliott Hill said Nike is “in the middle innings of our comeback,” pointing to progress in areas the company prioritized early and confidence in steps being taken to support long-term growth and profitability.

Meanwhile, CFO Matthew Friend said Nike delivered modest top-line growth while navigating headwinds from repositioning the business, adding the company is making changes to support a “full recovery” and the long-term health of its brands.

How Did Stocktwits Users React?

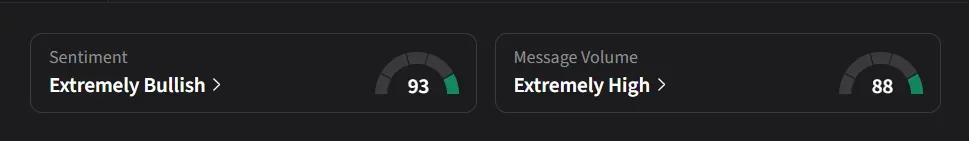

On Stocktwits, retail sentiment for Nike was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user claimed, “this makes no sense however since everybody’s panicking and running for the doors while the sale is on, I’m gonna buy me some Nike.”

One user said tariffs are driving higher prices at Nike, reducing volumes, lifting sales through pricing rather than demand, and still squeezing margins.

Nike’s stock has declined 11% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)