Advertisement|Remove ads.

Retail Investors Cheer Nikola Corp Following Upbeat Sales, Narrowing Losses

Fuel-cell electric vehicle maker Nikola Corp, on Friday, announced its second-quarter earnings that surpassed analyst estimates on multiple counts pushing the stock higher by 7%.

The firm reported an earnings loss of $2.67 per share, which more than halved from the loss of $5.90 recorded in the same quarter a year ago and beat an estimated loss of $2.77. Its net loss came down to $133.67 million versus $140 million in the second quarter of last year.

Total revenue nearly doubled to $31.32 million on a year-over-year (YoY) basis and topped an estimate of $26.20 million. This is the strongest topline recorded by the firm ever, jumping 318% on a quarter-over-quarter (QoQ) basis.

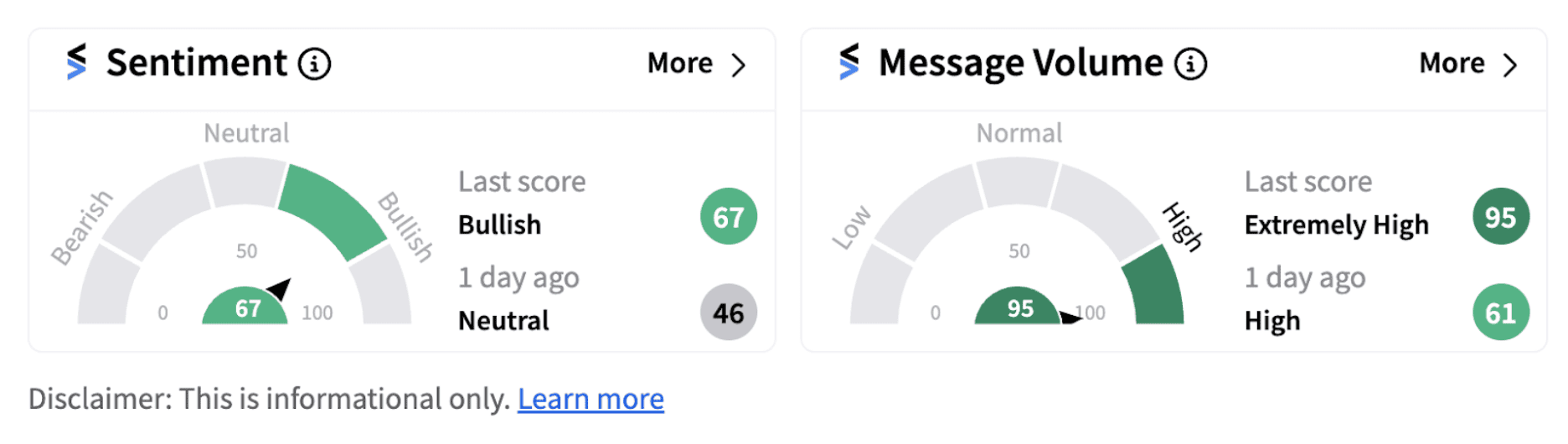

Following the announcement, retail sentiment on Stocktwits flipped into the ‘bullish’ territory (67/100) from the ‘bearish’ zone a day ago. The move was supported by ‘extremely high’ message volumes.

The rise in revenue was led by the surge in the number of trucks produced and sold during the quarter. Nikola disclosed that it produced 77 trucks during the quarter, more than double the number in the same period a year ago. The firm shipped 73 trucks versus 43 in Q2 of 2023. The firm also received repeat orders from two national accounts.

Interestingly, the company said it created alternative revenue streams from the sale of regulatory credits. “We recognized our first sale agreement of NOx and PM credits in the quarter. We expect this revenue stream to grow as volume increases each model year,” the firm stated.

Notably, from its highs in 2020, the stock has lost over 99% of its value. However, at current levels of about $8, retail investors believe there could be attractive upside potential. As one Stocktwits user named “amberajax2point0” points out, the stock should bottom-out given the momentum behind the business.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255549216_jpg_9d667bccbf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_7198eb982c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strategy_logo_jpg_3f91d3a35b.webp)