Advertisement|Remove ads.

Nio Stock Tumbles As Wall Street Cuts Targets On ‘Weak’ Q4 Outlook — But Retail Traders Are Bullish Over Longer Horizon

- Nio shares fell after analysts downgraded the stock and flagged slower demand heading into 2026.

- The company’s Q3 results showed revenue slightly below expectations despite strong delivery growth.

- Retail traders on Stocktwits turned upbeat, with a poll showing broad support for Nio over major EV rivals.

Nio Inc.’s U.S.-listed shares fell on Tuesday after the Chinese EV company’s third-quarter results and a wave of cautious analyst updates pointed to a softer finish to the year and slowing demand momentum heading into 2026.

The stock closed 4.4% lower at $5.5 on Tuesday before edging up 0.7% in after-hours trading.

Analysts Cut Ratings On ‘Weak’ Q4 Outlook

Macquarie downgraded Nio to ‘Neutral’ from ‘Outperform’ and cut its price target to $5.3 from $6.7 following the third quarter (Q3) report, after the company issued what it called ‘weak’ fourth quarter (Q4) vehicle volume guidance of 122,500 units at the midpoint, below its earlier outlook of 150,000 units.

Macquarie said the phaseout of government subsidies had hurt demand for the Onvo brand and cut its estimates for Nio on slower market demand in fiscal 2026, noting that with no new model launches expected until the second quarter (Q2) next year, demand is likely to remain weak in the first quarter (Q1) as well.

Bank of America Securities also lowered its price target to $6.7 from $7.6 and kept a ‘Neutral’ rating. The firm noted that vehicle sales volume rose 41% year-on-year in the third quarter (Q2), but average selling prices declined due to product mix changes. It added Nio’s Q4 delivery target of 120,000 to 125,000 units, while sharply higher than last year, remained well below the company’s previous guidance, Investing noted.

Morgan Stanley Reiterates ‘Overweight’ Call

Morgan Stanley maintained its ‘Overweight’ rating and $9 price target, pointing to Nio’s cost-reduction plans and its scheduled product launches. The firm expects Nio to introduce three large SUVs, including the ES9, ES7 and Onvo L80, in Q2 and Q3 of 2026, supporting higher volume growth that year.

Nio targets a 20% gross profit margin in 2026, as it benefits from supply-chain efficiencies, scale and a favourable product mix, Morgan Stanley said, adding that the company plans to cap research and development expenses at 2 billion yuan per quarter and keep selling, general and administrative expenses at 10% of revenue. Morgan Stanley said those two measures could help the Nio achieve non-GAAP profit breakeven in 2026.

Q3 Earnings Review

Nio reported total revenue of 21.79 billion yuan, up about 17% year-on-year, but short of analyst expectations of 22.29 billion yuan. The company delivered 87,071 vehicles, an increase of 40.8% from a year earlier, supported by demand for the new Nio ES8, the Onvo L90 and the Firefly brand. Nio ended the quarter with 36.7 billion yuan in cash, restricted cash, investments and deposits, which it said should be sufficient for operations over the next 12 months.

Nio expects Q4 revenue to rise 66.3%–72.8% year-on-year to a range of 32.76 billion to 34.04 billion yuan, slightly below analyst expectations.

Stocktwits Users Favor Nio Over Rivals

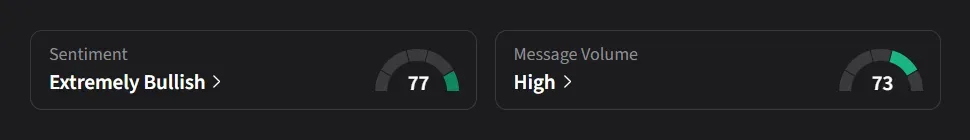

On Stocktwits, retail sentiment for Nio turned ‘extremely bullish’ on Tuesday amid ‘high’ message volume. A poll posted the same day showed 65% of 537 voters believed Nio has the strongest 12-month outlook, ahead of Tesla at 22%, Xpeng at 11%, and Li Auto at 2%, indicating retail traders remain comparatively optimistic despite the softer guidance.

One user said they saw Nio gaining market share as a pure new energy vehicle (NEV) player, noting that Tesla and Li Auto were dropping, Xpeng was losing share and Polestar was struggling.

Another user said they believed Nio shifted some revenue from the Q3 into Q4, reducing Q3 deliveries and pushing them into Q1 of 2026, while adding that Q4 other income should rise as chip payments arrive and that the company likely already knows where its numbers will land.

Nio’s U.S.-listed stock has risen 26% so far in 2025.

($1=7.08 yuan)

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)