Advertisement|Remove ads.

Nike Stock Tanks Pre-Market After Guidance Withdrawal, Investor Day Delay: Analysts Split, Retail Buzz Builds

Nike Inc. shares plunged more than 7% in pre-market trading on Wednesday after the sneaker giant withdrew its annual guidance and postponed its investor day event.

The company cited the need to reassess its strategic direction under incoming CEO Elliott Hill, who will take the helm on October 14.

Despite reporting first-quarter net income of $1.05 billion, or $0.70 per share, that topped analyst estimates, Nike’s revenue of $11.59 billion fell slightly short of expectations.

The company also warned that revenue for the second quarter would likely decline between 8% and 10% due to heightened promotions and weaker pricing power.

Wall Street’s reaction to Nike’s announcement has been mixed, with several analysts adjusting their price targets and outlooks.

Barclays reduced its price target for Nike from $84 to $81, maintaining an ‘Equal Weight’ rating. The firm criticized Nike’s first quarter as a “low-quality” result, citing slowing sales trends in both direct-to-consumer and wholesale channels.

Barclays also pointed out that Nike’s inventory is now growing faster than its sales, which poses risks heading into the second quarter.

BofA Securities trimmed its price target from $104 to $100 but kept a ‘Buy’ rating. BofA noted that while Nike’s first-quarter EPS beat expectations, sales slid in line with estimates.

The brokerage remains optimistic about new CEO Hill’s potential to reset the company’s strategy, suggesting this leadership change could mitigate risks of future sales misses.

On the other hand, UBS took a more cautious stance. The brokerage raised its price target slightly from $78 to $82 but retained a ‘Neutral’ rating.

UBS believes the weak earnings report was expected and sees significant downside risks, such as ongoing weaknesses in core styles and Nike’s performance in China, where competitive pressures are intensifying.

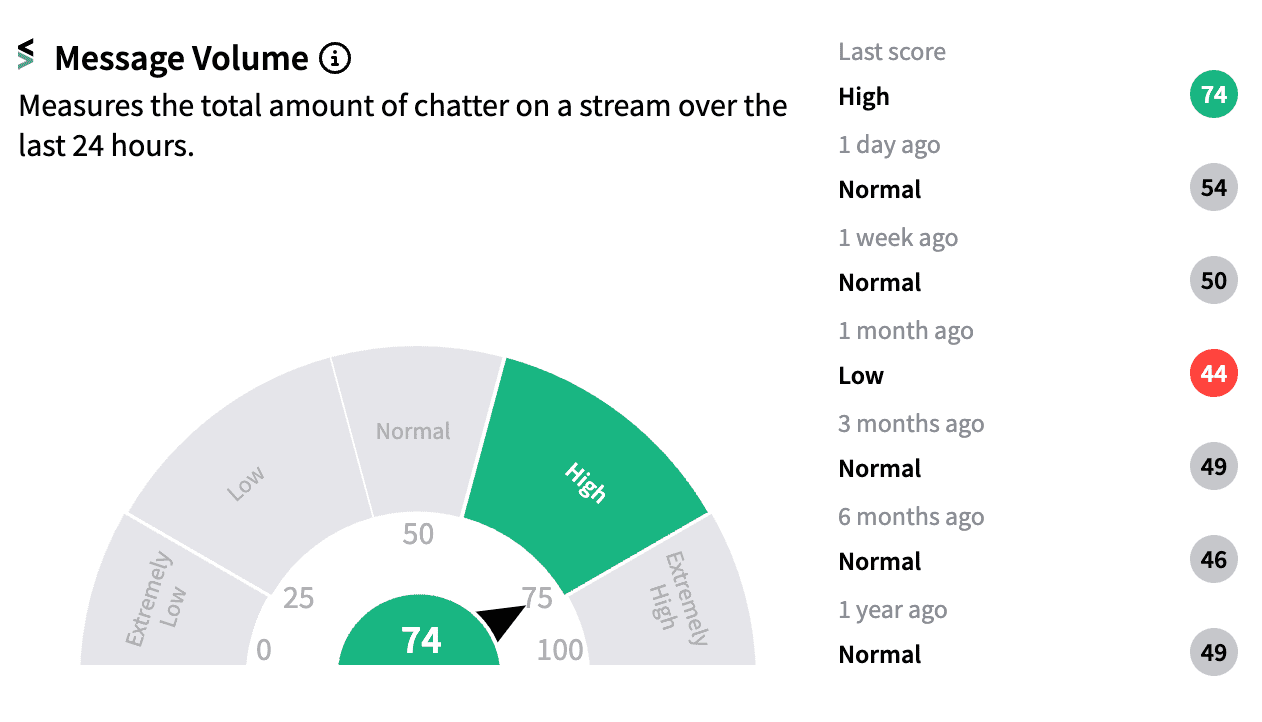

Retail investors were buzzing on Stocktwits, where Nike was the top-trending ticker early on Wednesday.

User comments reflected a range of opinions on the stock, with some expressing caution over Nike’s high valuation and the decision to pull its guidance.

Nike’s stock is down 16% year-to-date, reflecting broader struggles within the retail sector. Cost-conscious consumers are pulling back on discretionary spending, with athletic gear falling lower on their shopping lists.

Operational challenges in Nike’s direct-to-consumer business are further compounded by rising competition, particularly in North America and Europe.

The company also faces uncertainty in China, a key growth market, and is reportedly grappling with the aftermath of flooding the market with Jordan 1s, Air Force 1s, and Dunk sneakers, which has diluted demand for these iconic models.

Read next: Shattuck Labs Stock Nosedives As Lead Cancer Therapy Fails: Retail Enthusiasm Evaporates

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)