Advertisement|Remove ads.

Nike Stock Gains As Q1 Earnings Loom: Retail Investors See Rebound Potential Despite Wall Street Concerns

Nike, Inc. ($NKE) shares climbed nearly 1% on Tuesday ahead of its highly anticipated fiscal first-quarter earnings report, set to be released after the market close.

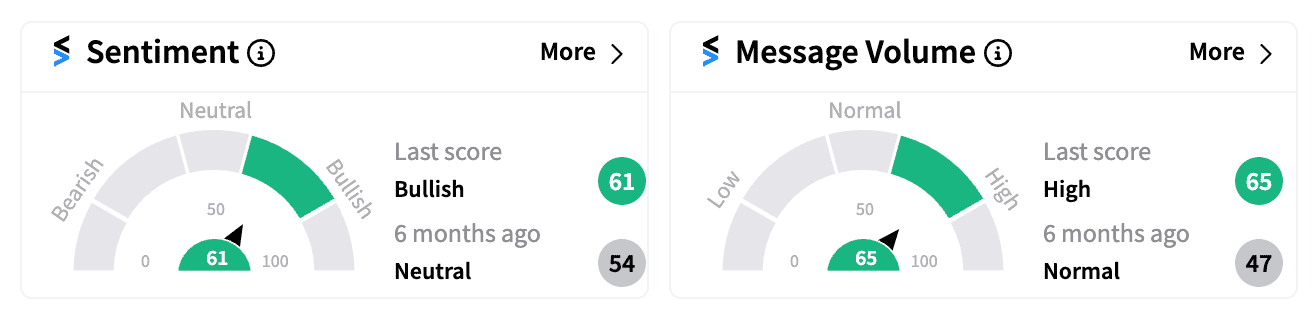

Retail sentiment is riding high, with a surge of optimism on Stocktwits flipping sentiment from ‘bearish’ to ‘bullish’ as message volume spiked.

For fiscal Q1 2025, Wall Street has set modest expectations for the world’s largest sneaker company.

According to LSEG consensus estimates, analysts forecast Nike’s earnings per share (EPS) to come in at $0.52, with revenue of $11.65 billion. Sales are expected to fall 10% from the same period last year, and profits anticipated to plunge by nearly 45%.

While the outlook may seem bleak, some retail investors believe Nike could outperform expectations.

On Stocktwits, one user predicted a 30% jump in the stock price after earnings, while another called for a short squeeze, citing leadership changes, share buybacks, and new partnerships as catalysts for a potential rebound.

Nike is going through a pivotal phase. It recently brought back former senior executive Elliott Hill to succeed John Donahoe as CEO.

Hill, who served Nike for 32 years and was instrumental in leading commercial and market operations for the Nike and Jordan brands, is expected to drive product innovation and rebuild wholesale partnerships.

Deutsche Bank has expressed confidence in Nike’s turnaround strategy, stating that Hill’s leadership will inject a “sense of urgency” that was missing under previous management.

Jefferies, however, maintains that expectations for Q1 are “fairly low,” citing soft foot traffic and rising competition from brands like Hoka and On Running.

Nike’s stock is down 16% year-to-date as higher prices for essentials have forced consumers to focus on necessities, leaving athletic gear off their shopping lists.

Moreover, Nike’s once-strong direct-to-consumer business has encountered operational challenges, and the brand faces mounting competition, particularly in North America and Europe, as well as uncertainty in China.

Morgan Stanley believes Hill’s appointment is a positive step but warns that a fiscal year guidance cut could come with Nike’s Q1 earnings report. Additionally, the brokerage speculates that Nike may cancel its upcoming investor day, giving Hill more time to assess the business and roll out a revamped strategy.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)