Advertisement|Remove ads.

Boeing Rises As Big Defense Contract Win Outweighs $10B Stock Sale Plan: Retail Investors Stay Bullish

Shares of Boeing Co. ($BA) rose over 1% on Tuesday, recovering from earlier losses, as optimism from retail investors mirrored broader market sentiment.

Bloomberg reported that Boeing is considering raising at least $10 billion through a stock sale to boost its cash reserves, which have been further strained by an ongoing machinists’ strike. Some analysts had anticipated this move earlier.

Boeing is reportedly working with advisers, but the capital raise may not occur for at least a month, depending on the resolution of the strike.

The company on Monday made its “best and final” offer, proposing a 30% wage increase over four years, which the machinists union rejected.

The strike, which began on Sept. 12, involves 33,000 workers demanding higher pay.

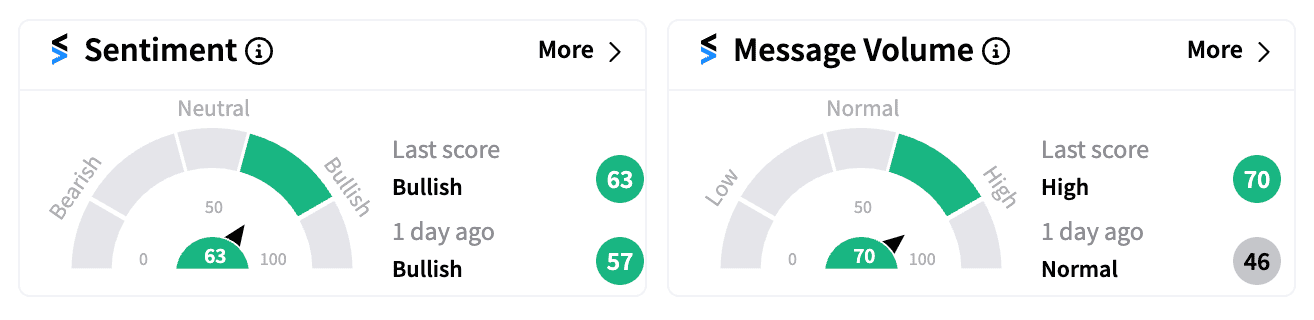

Still, retail sentiment on Stocktwits turned more ‘bullish’ on Tuesday, with increased message volume.

This optimism was fueled by Boeing’s announcement late Monday of five new and modified Defense Department contracts worth at least $8.46 billion.

However, Wall Street is cautious.

Wells Fargo lowered its price target on Boeing to $110 from $119, maintaining an ‘Underweight’ rating.

The brokerage expressed concerns about Boeing’s Q3 results, due on Oct. 30, citing the ongoing strike and reduced inventory liquidation as factors dragging down free cash flow.

TD Cowen also trimmed its price target on Boeing to $200 from $230 while keeping a ‘Buy’ rating. The brokerage noted that while the machinists’ strike poses risks to Boeing’s investment-grade rating, potential divestitures and strong free cash flow recovery could mitigate those concerns by 2025-27.

Boeing, which is facing its worst crisis in years due to production mishaps, safety issues linked to fatal crashes, and soaring debt, is down over 38% this year.

Analysts fear that a downgrade of Boeing’s $58 billion debt to junk status would make it even more expensive for the company to service its obligations.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)