Advertisement|Remove ads.

NKTR Stock Skyrockets: Wall Street Sees Up To 200% Upside As Skin Trial Crushes Even Bull-Case Forecasts

- BTIG, William Blair and H.C. Wainwright pointed to roughly 170%–200% upside from the stock’s last close.

- Analysts cited durable, deepening responses for Rezpegaldesleukin, highlighting sustained efficacy with monthly and quarterly dosing.

- Nektar also launched a $300 million public offering, with proceeds earmarked for R&D and Phase 3 trials of Rezpegaldesleukin.

Shares of Nektar Therapeutics (NKTR) logged its strongest session in 19 months on Tuesday after Wall Street analysts lifted price targets and pointed to triple-digit upside following “robust” results from the company’s atopic dermatitis trial.

NKTR stock surged 51% on Tuesday to hit $56 and jumped another 5% in after-hours trading.

Wall Street View On NKTR

BTIG raised its price target on Nektar to $151 from $118, implying an upside of roughly 170% from the stock’s last close, and reiterated a ‘Buy’ rating. The firm said it updated its Rezpegaldesleukin market model to reflect potential first-line use in advanced-therapy-eligible atopic dermatitis patients and said it expected new and deepening responses to emerge as a key differentiator, which it said were “persuasively confirmed” in the 52-week data.

William Blair upgraded Nektar to ‘Outperform’ from ‘Market Perform,’ citing continued deepening of response and durability with longer-term data, adding that there was no meaningful deterioration in efficacy when comparing monthly dosing with quarterly dosing. The firm also noted the absence of reported cases of conjunctivitis, erythema, oral ulcers, cardiovascular adverse events, or malignancies in the Rezolve-AD study.

Additionally, H.C. Wainwright raised its price target on Nektar to $165 from $135, implying an upside of roughly 200% from the stock’s last close, and reiterated a ‘Buy’ rating. The brokerage said it increased its assumed probability of launch to 60% from 50% and peak penetration to 15% from 10% for Rezpegaldesleukin. The firm said the 52-week results were “robust” and "readily beating all bull case expectations."

What The 52-Week Skin Data Showed

Nektar said updated Rezolve-AD maintenance data showed that a large proportion of patients maintained their earlier improvements or achieved new benefits across key measures of skin disease severity and itch, with both monthly and quarterly dosing.

The company reported that between 71% and 83% of patients maintained symptom improvement on higher-dose regimens at one year, while complete skin clearance rates increased two to five-fold during the maintenance phase.

Nektar Launches $300M Public Offering

Separately, Nektar said it has launched a proposed public offering of $300 million in common stock and pre-funded warrants, with an option for underwriters to purchase up to an additional $45 million. The company said proceeds are intended for general corporate purposes, including research and development, Phase 3 clinical trials for Rezpegaldesleukin, and manufacturing support.

How Did Stocktwits Users React?

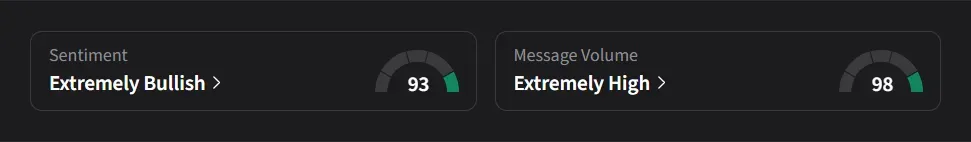

On Stocktwits, retail sentiment for NKTR jumped from ‘bullish’ to ‘extremely bullish’ after the trial results, amid a surge of over 3,000% in 24-hour message volume.

One user called the stock “the perfect 'risk' long investment $100+in a few months.”

Another user said NKTR stock “should go to $80 assuming they didnt raise at like <$45”

NKTR stock has surged more than 400% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_target_logo_resized_jpg_3025bd9bb0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_job_seekers_florida_resized_jpg_742e535d49.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Altcoins_ff3521c963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)