Advertisement|Remove ads.

NMDC’s Diversification Into Rare Earths Draws Investor Attention

NMDC shares have rallied over 20% in the last six months as the largest iron ore producer in the country looks to make a shift towards critical minerals.

According to SEBI-registered investment advisor Wealth Wishers, NMDC is evolving from a traditional iron ore producer into a diversified player. With strong fundamentals, government backing, and a foray into critical minerals, they believe it could emerge as one of the key beneficiaries of India’s push for mineral self-sufficiency and green industrialization.

Betting On Rare Earth Minerals

Following recent global disruptions, such as China’s restrictions on rare earth element exports, India has initiated the National Critical Minerals Mission, focusing on self-reliance in critical and rare earth minerals that are required for renewable energy, EV batteries, and advanced manufacturing.

NMDC has begun diversifying into critical minerals exploration and will collaborate with Hancock Prospecting in Australia for lithium exploration, marking its entry into high-potential future resources.

India currently imports nearly 90% of its critical mineral requirements, making NMDC’s entry into this space a strategically significant move. Going forward, NMDC’s transition into critical minerals may take time and require high capital expenditures with uncertain short-term returns, according to the investment advisor.

NMDC’s Big Moves In 2025

Looking to strengthen its dominance and cater to India’s growing infrastructure and steel demand, the Navratna public sector enterprise recently announced plans to double its iron ore production capacity from 50 million tons to 100 million tons by FY30.

NMDC is also developing a 135 km slurry pipeline to transport iron ore fines more efficiently. This will significantly reduce dependency on rail and road logistics, cut transportation costs by nearly 50%, and support NMDC’s shift towards green and clean logistics, Wealth Wishers noted.

They added that NMDC’s financial metrics reflect a fundamentally strong company with stable returns and attractive dividend payouts.

However, not all is green for the company. The advisor noted that, as a government-owned entity, decision-making can sometimes be slower than that of its private peers. Additionally, iron ore and metal prices are cyclical and heavily dependent on global demand, particularly from China.

Wealth Wishers concluded that NMDC’s initiatives could significantly enhance its long-term growth prospects. And while short-term performance will still be influenced by commodity cycles, the company’s focus on self-reliance, green logistics, and resource diversification positions it well for the next decade.

What Is The Retail Mood?

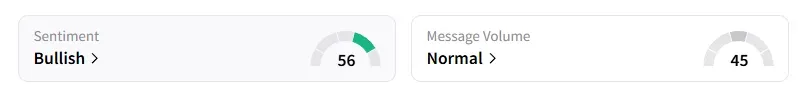

Data on Stocktwits shows that retail sentiment improved to ‘bullish’ a day ago on this counter. It was ‘neutral’ last week.

NMDC shares have risen 15% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)