Advertisement|Remove ads.

Norway’s $1.9 Trillion Wealth Fund Turns Against Elon Musk’s $1 Trillion Pay Package; Tesla Traders Brace For Turbulence

- Norges Bank Investment Management, Tesla’s seventh-largest shareholder with a 1.12% stake, said it will vote against Musk’s proposed pay plan, citing concerns over its size, dilution, and reliance on one individual.

- The fund also plans to oppose two Tesla board members and the company’s general stock compensation plan, diverging from investors like Baron Capital, which voiced support.

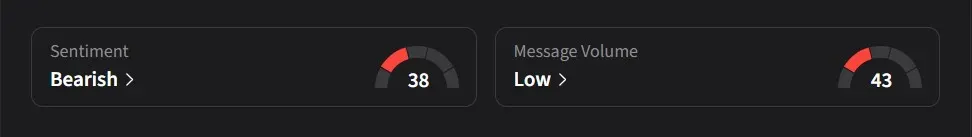

- On Stocktwits, retail sentiment leaned bearish ahead of Thursday’s vote, with traders expecting near-term volatility and uncertainty around Musk’s future at the company.

Norway’s $1.9 trillion sovereign wealth fund said it will vote against Tesla CEO Elon Musk’s proposed compensation plan, which could be worth as much as $1 trillion in shares if approved by the company’s annual meeting this week.

The fund, which is by far Tesla’s largest outside investor to reveal its voting stance, is taking the unusual step of publicly criticizing one of the world’s most high-profile CEOs, Reuters reported.

Largest Outside Investor To Disclose Opposition

The vote comes ahead of Tesla’s annual shareholder meeting on Nov. 6, when investors will also decide whether to ratify what may become the biggest CEO pay package ever. Baron Capital, another top investor, said Monday it will support the proposal, while other top shareholders such as BlackRock, Vanguard, and State Street have not yet disclosed their positions.

Norges Bank Investment Management (NBIM), which manages the world’s biggest sovereign wealth fund and has a 1.12% stake in Tesla worth $17 billion, said its decision aligned with its broader views on executive compensation and corporate governance.

Concerns Over Scale, Dilution, And Key Person Risk

“While we appreciate the significant value created under Mr. Musk’s visionary role, we are concerned about the total size of the award, dilution, and lack of mitigation of key person risk,” NBIM said on its website.

Tesla’s board has urged shareholders to approve the plan, with Chair Robyn Denholm warning that Musk could leave the company if the deal is rejected. The proposed package would grant Musk an additional 12% stake in Tesla if he increases its valuation to $8.5 trillion within the next decade, which is almost eight times its current value.

Wider Voting Opposition

NBIM also said it would vote against two of Tesla’s three board members up for re-election, Kathleen Wilson-Thompson and Ira Ehrenpreis, while backing Joe Gebbia, who joined the board in 2022. The fund also plans to vote against Tesla’s general stock compensation plan, citing concerns that it could indirectly benefit Musk.

Tesla argues that Musk will earn “nothing” unless the company hits ambitious milestones, with the full award only payable if Tesla achieves the $8.5 trillion target.

On Stocktwits, retail sentiment for Tesla was ‘bearish’ amid ‘low’ message volume.

Stocktwits Traders Brace for More Pain Ahead Of Tesla’s Pay Vote

One user said they expect Tesla’s shares to bounce back by the time European markets open, brushing off any initial weakness.

Another user predicted that the stock could see further selling ahead of the shareholder vote, adding that few investors would want to hold it amid such uncertainty. They noted that if Musk were to be voted out, the market’s reaction would likely be severe.

Tesla’s stock has risen 16% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)