Advertisement|Remove ads.

Norwegian Cruise Stock Dips On Share Offering, Stifel Sees Buying Opportunity

Norwegian Cruise Line Holdings (NCLH) shares dropped nearly 3% during midday trading on Monday after a subsidiary of the cruise operator announced a debt tender offer. At the same time, the company commenced an equity offering.

The company commenced a registered direct offering of ordinary shares to certain holders of its subsidiary NCL Corporation’s 1.125% Exchangeable Senior Notes and 2.50% Exchangeable Senior Notes, both due 2027.

Norwegian Cruise said it intends to use the net proceeds from the equity offering, together with the net proceeds of NCL Corporation’s separately-announced private offering of exchangeable senior notes due 2030, to repurchase a portion of the 2027 exchangeable notes.

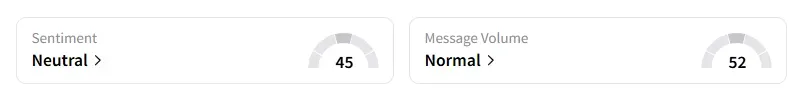

Retail sentiment on Norwegian Cruise jumped to ‘neutral’ from ‘extremely bearish’ territory a day ago, with message volumes at ‘normal’ levels, according to data from Stocktwits.

A bullish user on Stocktwits opined that this is not a move out of necessity, but a calculated move to create balance sheet liquidity and reduce interest debt.

Brokerage Stifel maintained a ‘Buy’ rating and $35 price target on the stock, according to TheFly. The firm believes the market is misinterpreting the company's capital market transactions announced on Monday.

Stifel noted that after speaking with the company and understanding the mechanics of the capital transactions, it is clear that these transactions are a positive for the company, as they do not increase its diluted share count and lower its overall borrowing costs.

The firm added that, on a net basis, it would use this weakness as a near-term buying opportunity for Norwegian.

Another user on Stocktwits said that the dip on Monday presented a good opportunity.

Shares of Norwegian Cruise have declined nearly 3% this year and more than 43% over the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strategy_logo_OG_jpg_fa4e1a7d04.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206312585_jpg_1a7c050dff.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232490693_jpg_6d25778555.webp)