Advertisement|Remove ads.

Nu Skin Stock Surges After-Hours On Strong Q4 Performance: Retail Cheers

Shares of Nu Skin Enterprises Inc. ($NUS) surged more than 24% in after-hours trading on Thursday after the company’s better-than-expected fourth-quarter earnings, lifting retail sentiment.

Nu Skin Q4 earnings per share came in at $0.38, beating consensus estimates of $0.22, while revenues stood at $445.55 million, surpassing estimates of $436.05 million, according to Stocktwits data.

Its board declared a quarterly cash dividend of $0.06 per share, which will be paid on March 5, 2025, to shareholders of record on Feb. 24, 2025.

“We were pleased to beat our fourth quarter revenue guidance, generate sequential revenue growth and exceed our adjusted earnings as we materially completed our restructuring plan," said Ryan Napierski, Nu Skin president and CEO. “As we look ahead to 2025, we anticipate improving business trends and a return to year-over-year growth in several of our markets but also anticipate continued economic challenges and poor consumer sentiment, particularly in Greater China and South Korea.

Nu Skin plans to focus on strengthening its core business with the rollout of its sales performance compensation plan in several markets and accelerating growth in developing markets including Latin America, added Napierski.

For 2025, its annual revenue guidance is $1.48 to $1.62 billion, with about 3% of foreign currency headwind. That is below the $1.7 billion expected by analysts, according to Fly.com.

The company expects adjusted EPS to be $0.90 to $1.30, excluding the gain from the sale of Mavely. That compares to consensus estimates of $0.76.

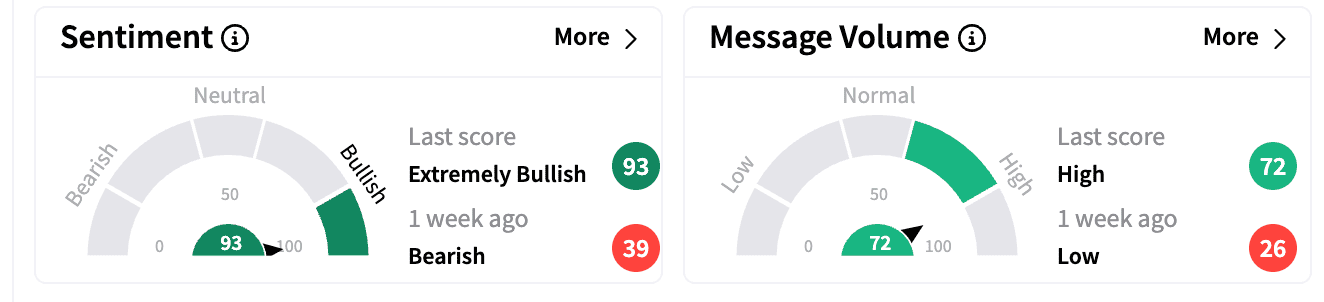

Sentiment on Stocktwits improved to ‘extremely bullish’ from ‘bearish’ a week ago. Message volumes climbed to the ‘high’ territory from ‘low.’

Nu Skin Enterprises, focused on beauty and wellness, operates Nu Skin and Rhyz Inc., operating in nearly 50 markets worldwide.

Nu Skin stock is down 6.8% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2236469013_jpg_0a72164947.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244672917_jpg_95b721e1af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195597245_jpg_c1df83b829.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paypal_BTC_ETH_OG_jpg_566a59dd7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)