Advertisement|Remove ads.

Novavax Lands Wall Street 'Buy' Rating After Q4 Results, Retail Bulls Eye More Upside On Sanofi Partnership

Novavax Inc. (NVAX) shares climbed over 1% in after-hours trading Thursday as the vaccine maker's revenue outlook and cost-cutting measures reassured investors.

The momentum was aided by BTIG initiating coverage with a 'Buy' rating, citing Novavax's key partnership with Sanofi (SNY) as a potential game-changer. The firm sees a nearly 170% upside for the stock.

Novavax reported a fourth-quarter loss of $0.51 per share, missing analyst expectations of a $0.43 loss. However, the company's net loss shrank 54% to $81 million, driven by lower commercialization expenses for its COVID-19 vaccine and reduced selling, general, and administrative (SG&A) costs.

Revenue reached $88.3 million, topping expectations of $84.38 million. While COVID-19 vaccine product sales plunged to $50 million from $251 million a year ago, licensing, royalties, and grants provided a boost, contributing over $38 million.

The company's $1.2 billion partnership with Sanofi, signed last May, represents a strategic shift — handing over U.S. and European vaccine sales rights in exchange for milestone payments and royalties.

Under the deal, Sanofi will take the lead in commercializing Novavax's vaccines starting with the 2025-2026 flu season in select markets, including the U.S.

Novavax expects to generate $300 million to $350 million in adjusted licensing, royalties, and other revenue in 2025 and will earn royalties ranging from the high teens to a low-20% range on Sanofi's sales.

BTIG analysts believe Novavax's standalone protein-based shot has a strong efficacy and safety profile, positioning it as a significant player in the $9 billion COVID vaccine market with Sanofi's commercial backing. The research firm set a $19 price target for the stock.

On the earnings call, Novavax CEO John C. Jacobs reinforced the company's pivot: "We will be generating revenue from milestones and working to build momentum on potential future royalties versus booking sales of our own in the COVID market. The shape of our company will change further."

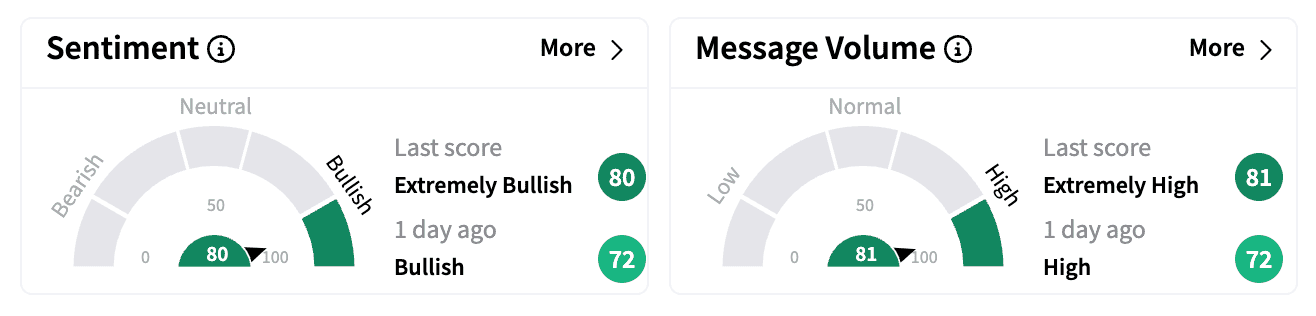

Retail sentiment on Stocktwits turned 'extremely bullish' following the earnings report, with message volume surging.

One user said Novavax would turn profitable in the first or second quarter of 2025, driven by more partnerships and the product pipeline.

Another said Novavax's shares were "crazy cheap" because the company had $1 billion in cash and a market cap of $1.17 billion.

Novavax shares remain down over 13% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Data_center_jpg_5f0fa8e828.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1760545615_jpg_9507fd561a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)