Advertisement|Remove ads.

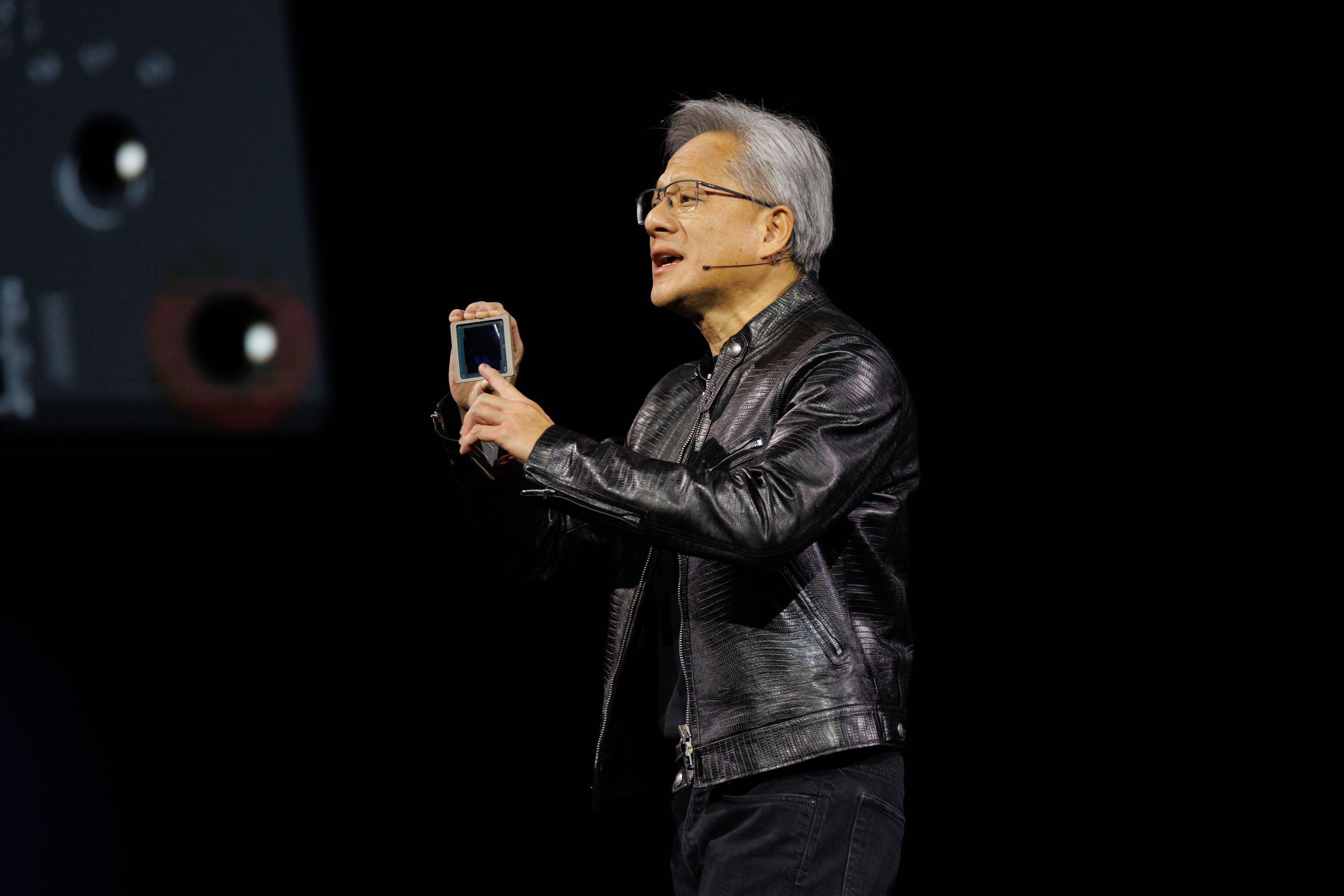

Nvidia Stock Garners Retail Buzz After CEO Touts ‘Insane’ Demand For Blackwell AI Chips

Shares of Nvidia Corp. (NVDA) climbed modestly in pre-market trading on Friday, building on the 3% gain from the previous session.

The stock was among the top five most active tickers on Stocktwits, where it has over 538,000 followers, driving high levels of interest from retail investors before the market opened.

Nvidia’s CEO, Jensen Huang, stoked enthusiasm during an interview with CNBC’s “Closing Bell Overtime” on Wednesday, stating that demand for the company’s next-generation Blackwell AI chips is “insane.”

“At a time when the technology is moving so fast, it gives us an opportunity to triple down, to really drive the innovation cycle so that we can increase capabilities, increase our throughput, decrease our costs, decrease our energy consumption,” Huang said, noting that everything is on track with the chip’s development.

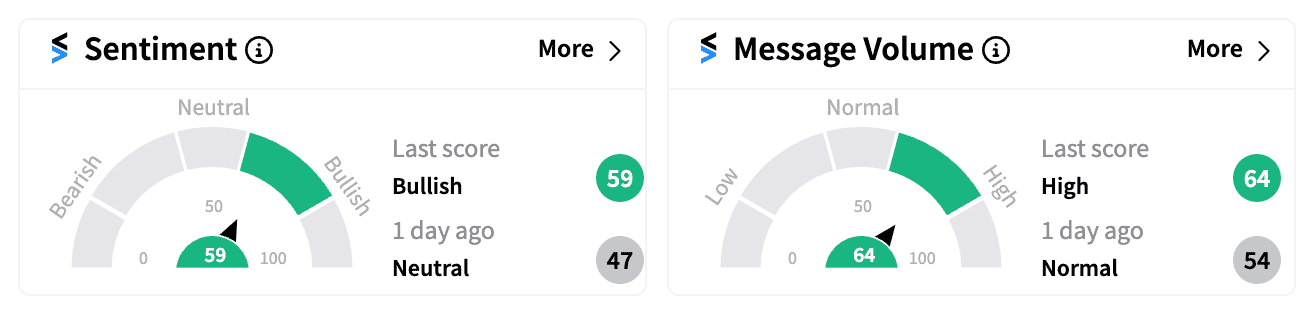

Retail sentiment on Stocktwits flipped to ‘bullish’ (59/100) from ‘neutral’ the day prior, alongside a surge in message volume.

Traders shared their optimism, with one user commenting that NVDA’s chart was looking like a “stairway to heaven pattern from yesterday’s lows,” while another anticipated a breakout.

Nvidia’s Blackwell AI chips, expected to cost between $30,000 and $40,000 per unit, are in high demand from companies like Microsoft (MSFT) and Meta (META), as well as others building AI data centers for products like ChatGPT and Copilot.

Still, Bank of America analysts have reportedly noted that Nvidia is still “relatively underweight” compared to other top semiconductor stocks in institutional portfolios, though it remains the most owned in the sector.

Nvidia has been a standout performer in 2023, soaring 155% on the back of the AI boom and standing out among the “Magnificent Seven” mega-cap tech stocks.

Read next: Amazon Stock Climbs After East Coast Port Strike Ends: Retail Enthusiasm Back Ahead Of Prime Day

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)