Advertisement|Remove ads.

Michael Saylor Says It’s ‘Probably Nothing’ After MSTR’s Bitcoin-Backed Loans Hit Record Volume

- This surge comes amid a broader boom in crypto-collateralized lending.

- Saylor has recently been focusing more on perpetual preferred stocks, looking to take Strategy’s ‘Bitcoin Factory’ global.

- In recent interviews, the executive chairman has called Bitcoin “superior collateral.”

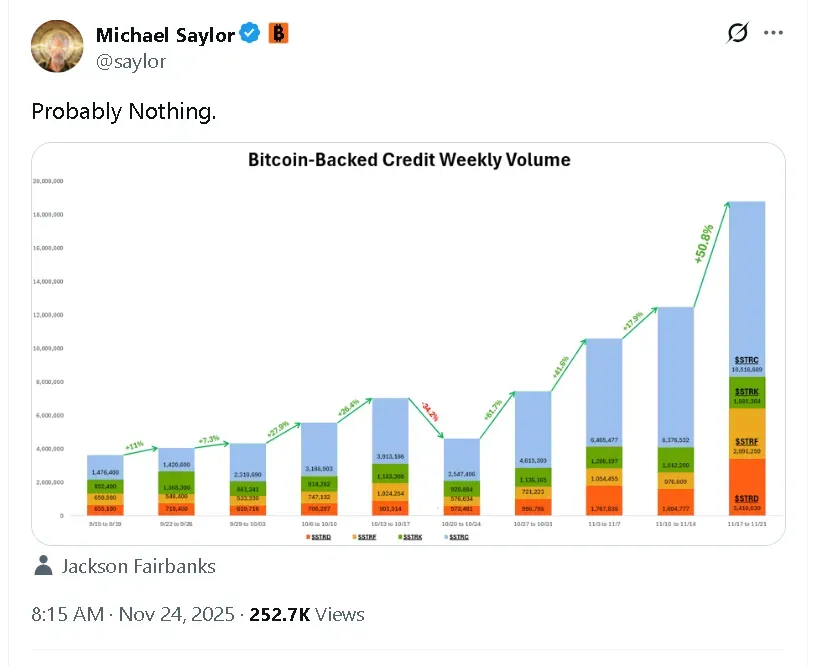

Strategy (MSTR) Executive Chairman Michael Saylor on Monday said it’s "probably nothing", sharing a chart that showed Bitcoin (BTC)-backed loans through its specialized digital structured products hit an all-time high last week.

According to the chart, for the week ending November 21, weekly volume across Strategy’s suite of offerings, which includes STRFC, STRF, TRF, and TRD, hit a new all-time high of $18.9 million. MSTR’s stock edged 0.7% higher at market open. On Stocktwits, retail sentiment around the stock surged to ‘extremely bullish’ from ‘bullish’ over the past day, amid ‘high’ levels of chatter.

Crypto-Backed Lending Surge

This surge comes amid a broader boom in crypto-collateralized lending. According to a November report by Galaxy Digital, crypto-backed loans expanded by $20.46 billion in the third quarter (Q3) 2025 to a record $73.59 billion in outstanding balances, surpassing previous bull-cycle peaks. This marked an increase of 38.5% year-on-year.

Saylor Shills Bitcoin-Backed Credit

After being a Bitcoin bull for years, Saylor has recently been focusing more on perpetual preferred stocks. These are flexible instruments that don’t mature and can skip dividends. He called them “revolutionary Bitcoin-backed treasury credit instruments” that reduce volatility and risk while providing monthly USD. Strategy’s BTC Credit Model leverages Bitcoin as “superior collateral,” enabling novel credit structures that may outperform traditional fiat-based ratios, according to Saylor.

Strategy also recently expanded the offering to Europe with the launch of euro-denominated perpetual preferred shares, Stream (STRE), targeting institutional investors across the European Economic Area.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)