Advertisement|Remove ads.

Amazon Stock Climbs After East Coast Port Strike Ends: Retail Enthusiasm Back Ahead Of Prime Day

Shares of Amazon.com, Inc. (AMZN) rose 1.7% in pre-market trading on Friday, on track to snap a seven-session losing streak, boosting retail sentiment.

The stock’s rebound followed news that U.S. dockworkers ended a three-day strike that had halted trade on the U.S. East and Gulf coasts.

The International Longshoremen’s Association and the United States Maritime Alliance reached a tentative wage agreement and extended the Master Contract until Jan. 15, 2025.

This move is crucial for consumer-facing companies that rely heavily on these key supply chain links, especially ahead of the peak holiday shopping season.

Shares of Walmart (WMT), Target (TGT), and Costco (COST) were also modestly higher following the news.

Amazon is also preparing for its Prime Day event, set for Oct. 8-9, which is expected to drive significant traffic and sales.

In other developments, JMP Securities analyst Nicholas Jones estimated that Amazon could save over $20 billion annually by adopting autonomous technology and electric vehicles, including Rivian Automotive (RIVN) delivery vans, in its logistics network. The brokerage maintained an ‘Outperform’ rating with a $265 price target.

Morgan Stanley echoed similar optimism, noting that Amazon’s efforts to streamline operations could result in $2-$4 billion in annual savings, boosting 2025 EBIT by 3-5%. The firm maintained an ‘Overweight’ rating with a $210 price target.

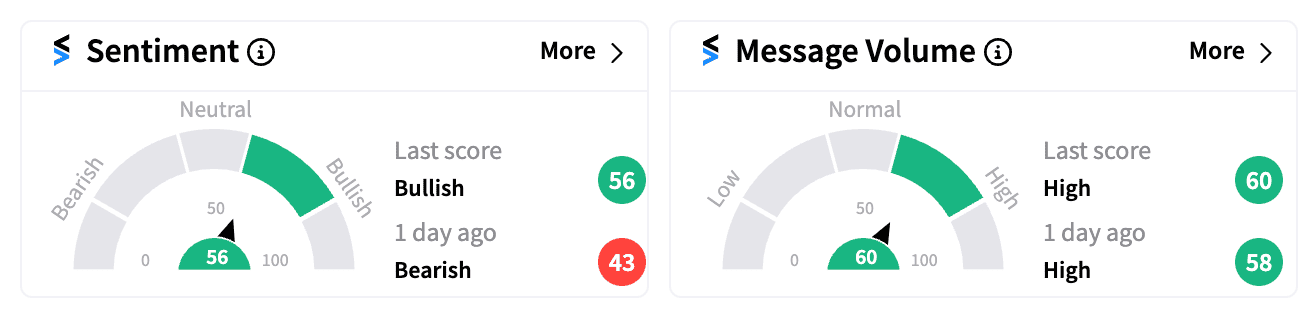

On Stocktwits, retail sentiment for AMZN turned ‘bullish’ (56/100) from ‘bearish’ the day prior.

Some retail users were optimistic about the port strike resolution, while others hoped for the stock’s return to the $200 level and the potential for strong upside heading into Q4.

Amazon stock, which is up about 20% year-to-date, remains 8% below its all-time highs from three months ago.

Additionally, the company is ramping-up plans to increase advertisements on Prime Video as it pushes deeper into ad-supported streaming services by 2025.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)