Advertisement|Remove ads.

Nvidia’s Much-Awaited Q1 Report Will Likely Reveal Dent From China Chip Curbs — Retail’s Guarded

Nvidia Corp.’s (NVDA) quarterly report is keenly awaited as the market has staged an uneven recovery from the Trump tariff-induced meltdown. The artificial intelligence (AI) stalwart’s stock has recovered nicely in recent sessions, partly factoring in a solid quarterly print.

According to the Finchat-compiled consensus, the Jensen Huang-led company is expected to report adjusted earnings per share (EPS) of $0.75 and revenue of $43.25 billion for the first quarter of the fiscal year 2026.

This would mark 23% and 66% increases, respectively, from the year-ago’s $0.61 and $26.04 billion.

Nvidia’s guidance issued in late February calls for revenue of $43 billion, plus or minus 2%, and non-GAAP gross margins of 70.6%-71%.

Previewing the results, Morgan Stanley analyst Joseph Moore said there is some downside potential relative to the consensus estimates as the sell-side hasn’t universally modeled the impact of the China chip curbs.

Nvidia revealed a $5.5 billion impact from the additional restrictions on the exports of the H20 China-specific chip in the April quarter, while Morgan Stanley's sees a 10% headwind in the July quarter.

“The key here is the optimism around GB200 improving, and strong demand, and if the company can make the case for that, the stock should react well, in our view, even if numbers don't change much,” he added.

On Stocktwits, retail sentiment toward Nvidia stock was ‘neutral’ (49/100) by early Wednesday, with the message volume at ‘normal’ levels.

A bullish watcher braced for “epic” earnings.

However, another user feared a billion-dollar miss. Some even speculated on a market crash if traders dump Nvidia following earnings.

The stock was the top trending ticker on the platform early Wednesday and among the top five active tickers.

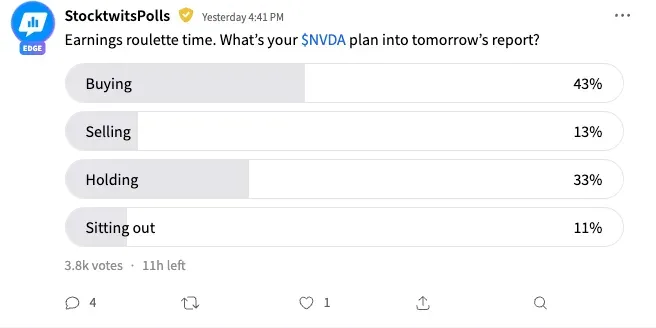

An ongoing Stocktwits poll that has received responses from 3,800 users found that 43% of the respondents plan to buy Nvidia stock going into the earnings report.

Those planning to hold accounted for 33% of the total, while 13% said they would sell and 11% planned to sit out.

Nvidia stock was up 0.16% at $135.72 in the early premarket session on Wednesday. The stock is up 0.90% for the year, although it is trading 11.5% off its Jan. 7 all-time high of $153.13.

The Koyfin-compiled consensus analysts’ estimate ($163.01) suggests the stock currently trades at a 17% discount.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)