Advertisement|Remove ads.

Nvidia CEO Eyes Massive US Manufacturing Expansion As Trump Tariff Threats Loom: Retail Sentiment Perks Up

Shares of Nvidia Corp. (NVDA) gained 1.6% in pre-market trading on Thursday, hours after CEO Jensen Huang announced that the company would spend several hundreds of billions of dollars in making chips and electronics in the U.S. over the next four years.

In an interview with the Financial Times, Huang highlighted Nvidia’s procurement outlay for the next four years, saying the artificial intelligence (AI) bellwether plans to spend half a trillion dollars on buying components as it feeds the demand for its AI chips.

“Overall, we will procure, over the course of the next four years, probably half a trillion dollars worth of electronics in total,” he said on the sidelines of the GTC 2025 event.

However, what’s interesting is that the AI giant is looking to fortify its U.S. supply chain as President Donald Trump pushes onshore manufacturing.

“I think we can easily see ourselves manufacturing several hundred billion of it here in the US,” he added.

Huang was also all-praise for the Trump administration’s energy expansion goals.

“Having the support of an administration who cares about the success of this industry and not allowing energy to be an obstacle is a phenomenal result for AI in the US,” he said, according to the report.

Aiding Nvidia in this endeavor is Taiwan Semiconductor Manufacturing Co. Ltd.’s (TSMC) facilities in the U.S. – Huang said Nvidia is now able to manufacture its latest AI chips in the country thanks to TSMC and Foxconn.

Moreover, TSMC has also pledged to invest up to $100 billion to set up a chip making facility in Arizona, amid ongoing tensions with China.

Nvidia announced a new open-source foundational model for humanoid robots, a new Blackwell chip, new graphics processing units (GPU), and more, at GTC 2025.

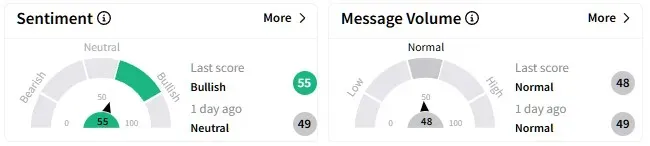

Retail sentiment on Stocktwits around Nvidia entered the ‘bullish’ (55/100) territory as investors continued to discuss the company’s announcements.

One user posted a technical analysis of the Nvidia stock, which has been making higher lows, pointing to a bullish pattern.

Data from Koyfin shows the average price target for Nvidia is $171.10, implying an upside of nearly 46% from current levels.

Of the 62 analyst ratings for the Nvidia stock, 57 have a ‘Buy’ or ‘Strong Buy’ rating, while five have a ‘Hold’ recommendation.

Nvidia’s stock is down over 12% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Civic_resized_jpg_120d89cac4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Opendoor_Technologies_jpg_177252e1f8.webp)