Advertisement|Remove ads.

Nvidia, CSX, Bank of America, SLB, Google: What Sparked Heavy After-Hours Trading In These 5 Stocks?

U.S. stocks closed mostly higher on Wednesday as Alphabet's (GOOGL) (GOOG) stock rally, underpinned by a relatively favorable antitrust ruling, helped offset economic concerns. The parent company of Google’s Class A shares soared over 9% to a record high.

The S&P 500 Index snapped a two-session losing streak and ended moderately higher, while the Nasdaq Composite advanced by more than 1%.

After the broader market posted its first gain for September, the following stocks saw substantial volumes in the extended sessions:

Nvidia Corp. (NVDA)

After-hours move: -0.13%

Trading volume: 11.96 million

Nvidia’s stock bucked the broader tech sector strength and ended lower for the fifth consecutive session on Wednesday amid a lack of company-specific stock-moving catalysts. The imminent release of Broadcom’s (AVGO) earnings may have introduced caution. Broadcom is due to report its quarterly results on Thursday after the market closes.

After the market closed, Nvidia disclosed in multiple filings that company insiders, including CEO Jensen Huang, had made stock sales. Nvidia has been under pressure ever since its quarterly report, as investors fretted about the China uncertainties.

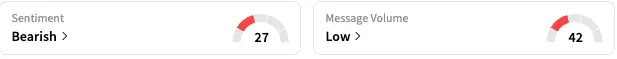

On Stocktwits, retail sentiment toward Nvidia stock flipped to ‘bearish’ (29/100) by late Wednesday from an ‘extremely bullish’ mood seen a day ago. The message volume tapered off to ‘low’ levels.

The recent string of losses has trimmed Nvidia stock’s year-to-date (YTD) gains to 27%.

CSX Corp. (CSX)

After-hours move: -0.28%

Trading volume: 8.7 million

Shares of railroad transportation company CSX rose modestly on Wednesday before edging lower in after-hours trading. The stock evinced interest among traders amid the ongoing news flow regarding industry consolidation.

Ever since peer Union Pacific (UNP) made an offer for Norfolk Southern (NSC), rumors regarding Warren Buffett-led Berkshire Hathaway-owned BNSF making a buyout offer to CSX have been doing the rounds.

CSX CEO Joe Hinrichs and Buffett have subsequently quashed the rumors.

CSX stock has gained merely 1.3% YTD. The stock has elicited ‘bearish’ sentiment (27/100) from among users of the Stocktwits platform, with the message volume at ‘low’ levels. Financial stocks

Bank of America Corp. (BAC)

After-hours move: unchanged

Trading volume: 6.32 million

BofA’s stock came on traders’ radar as the company’s management is set to meet with Seaport Research in New York on September 4. The stock has had a solid year, gaining over 15%, buoyed by higher interest rates and strong capital market activity.

Retail sentiment toward the stock remained ‘bearish’ (36/100) and the message volume stayed at ‘normal’ levels.

SLB Ltd. (SLB)

After-hours move: +0.11%

Trading volume: 5.29 million

Oilfield services company SLB also received attention despite the lack of any major catalysts to move the stock. This is despite the volatility seen in oil prices in recent sessions. The West Texas Intermediate (WTI) crude oil soared above $66 a barrel earlier this week before retreating below the $64 level.

The company announced on Wednesday that its Methane LiDAR Camera has been approved by the U.S. Environmental Protection Agency (EPA) as an alternative test method for methane detection.

SLB stock is down 6.6% this year.

On Stocktwits, retail sentiment toward the stock remained ‘bullish’ (60/100) and the message volume was at ‘normal’ levels.

Alphabet, Inc. Class C Stock (GOOG)

After-hours move: +0.35%

Trading volume: 4.89 million

Alphabet stock found follow-through buying in the after-hours session after the Class C stock settled the regular trading session up 9.01% at $231.10. The buoyancy followed a string of price target hikes for the stock after the antitrust ruling.

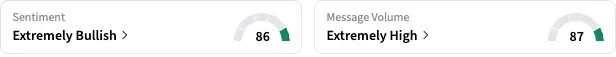

Retail sentiment toward the GOOG stock stayed ‘extremely bullish’ (86/100), and the message volume remained ‘extremely high.’

GOOG stock is up 21.6% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240705652_jpg_64172b74f3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_bull_OG_jpg_791f8f3b40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)