Advertisement|Remove ads.

Arm Stock Slides As Nvidia Trims Stake — But Retail Feels It Could've Been Worse

Arm Holdings PLC (ARM) fell as much as 4.5% on Friday afternoon after filings revealed that Nvidia (NVDA) had reduced its stake in the chip designer.

The AI giant trimmed its holdings in Arm by roughly 44%, while fully exiting its positions in Serve Robotics (SERV) and SoundHound AI (SOUN) — both of which saw sharp declines in morning trading.

Serve Robotics plunged over 40%, while SoundHound dropped more than 27%.

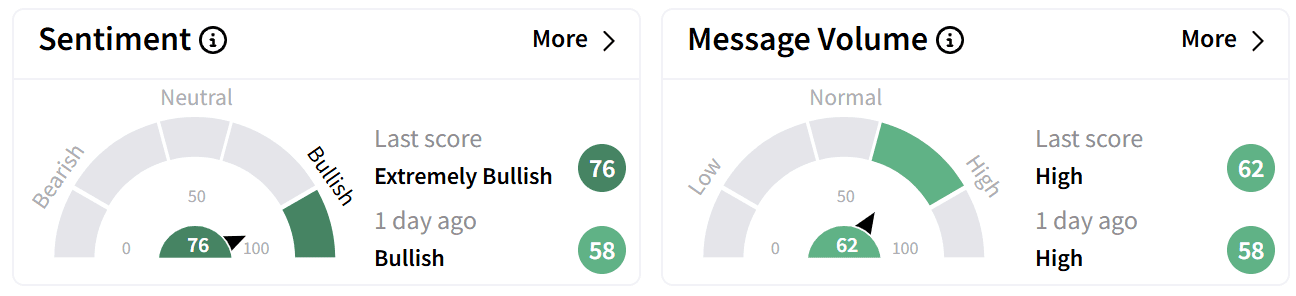

On Stocktwits, retail sentiment around ARM improved to ‘extremely bullish’ from ‘bullish’ accompanied by ‘high’ levels of chatter.

Some traders expressed relief that Nvidia didn’t liquidate its entire stake in Arm, fearing that a full exit could have worsened the sell-off.

Others were less forgiving, threatening to sell their Nvidia shares to buy more Arm stock instead.

Despite Friday’s decline, Arm shares remain up 17% year-to-date.

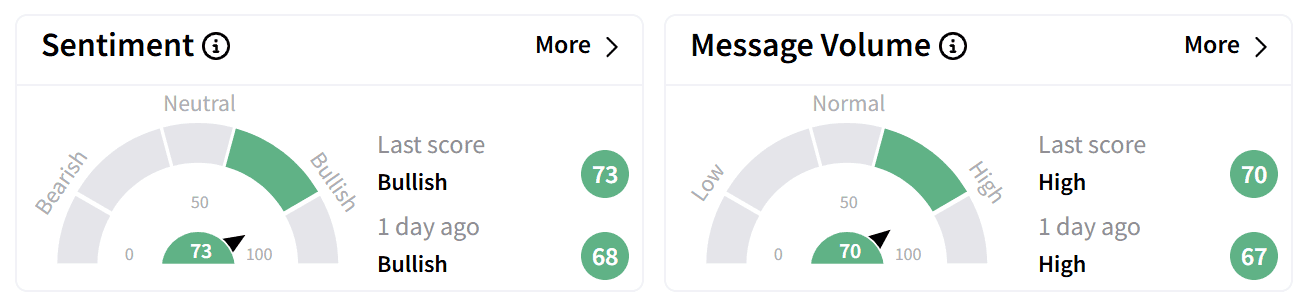

While Nvidia fully exited its stake in SoundHound, retail sentiment for the AI company remained ‘bullish’ accompanied by ‘high’ levels of chatter.

Many traders viewed the sell-off as an overreaction by the market.

SoundHound AI, which develops voice AI technology for businesses, is now trading at a two-month low.

The SOUN stock is on track for its steepest single-day decline in more than two years.

Still, it remains up 178% for the year.

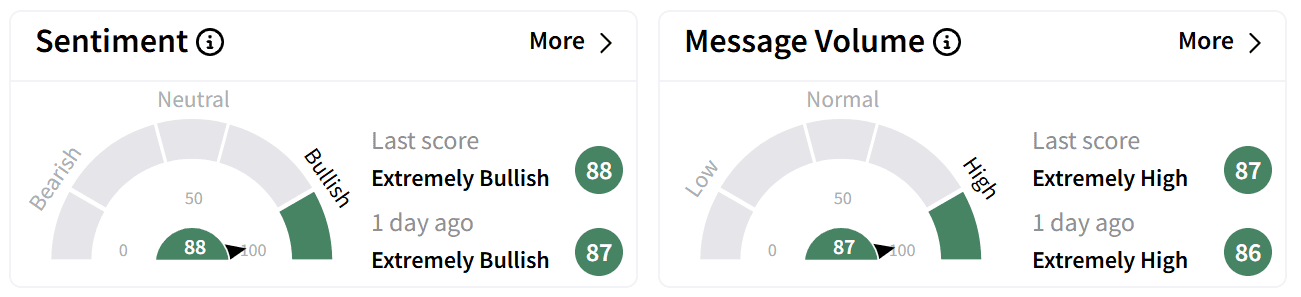

Serve Robotics, which specializes in autonomous, low-emission delivery robots, also saw heavy losses on Friday.

Yet, retail traders remained optimistic about retail sentiment on Stocktwits in the ‘extremely bullish’ territory accompanied by ‘extremely high’ chatter.

Serve Robotics Inc. specializes in self-driving, low-emission delivery robots designed for public spaces, with a primary focus on food delivery

Despite the drop, Serve Robotics stock is still up 185% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read more: Applied Digital Jumps On $375M SMBC Deal, Robinhood Stake – Retail Sentiment Improves

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)