Advertisement|Remove ads.

Applied Digital Jumps On $375M SMBC Deal, Hood Stake – Retail Sentiment Improves

Applied Digital Corp. (APLD) surged more than 12% on Friday morning after securing $375 million in financing from Sumitomo Mitsui Banking Corporation (SMBC) for its Ellendale high-performance computing (HPC) campus in North Dakota.

The stock was further propelled by filings that showed Hood River Capital Management had acquired 15 million shares of Applied Digital’s stock – representing 7.17% stake in the company – in addition to Nvidia retaining its stake in the company.

The flurry of news pushed the stock to among the top trending tickers on Stockwits on Friday morning.

According to a poll on Stocktwits, Applied Digital’s Ellendale HPC campus is one of the main reasons that retail traders are bullish on the stock.

Applied Digital said that a portion of the SMBC funding will be used to repay obligations under a senior secured note from Macquarie Capital, which had committed up to $5 billion toward Applied Digital’s AI data center business in Jan. 2025.

The remainder will go toward the development of the first two buildings on the Ellendale campus.

The company said it intends to replace the SMBC loan with permanent project financing, emphasizing that neither the interim loan nor its planned refinancing is expected to dilute common stock.

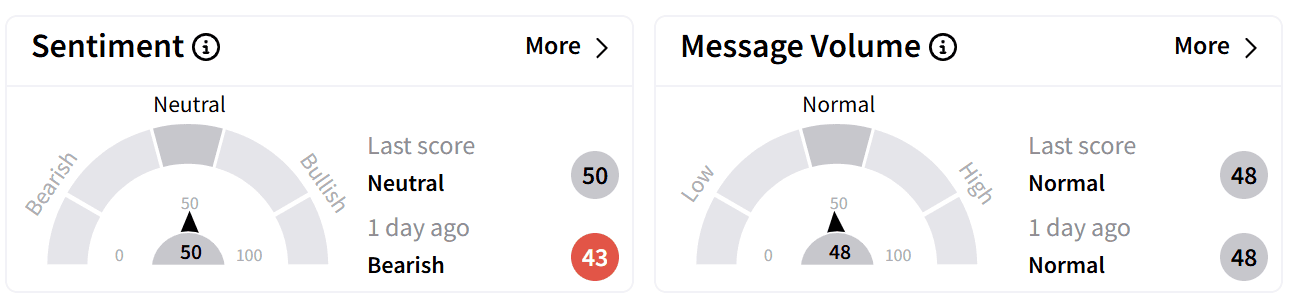

On Stocktwits, retail sentiment around Applied Digital improved to ‘neutral’ territory from ‘bearish’ a day ago accompanied by ‘normal’ levels of chatter.

In addition to the funding and Robinhood’s stake in Applied Digital, retail was also celebrating that Nvidia (NVDA) had maintained its investments in the company.

Despite gaining more than 70% over the past year, Applied Digital’s stock has traded flat year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Editor's note: This story has been updated to clarify that Hood River Capital, not Robinhood, acquired a stake in Applied Digital.

Read also: Retail Traders Bet On XRP To Beat SOL, ADA, LTC To An ETF Approval

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Civic_resized_jpg_120d89cac4.webp)