Advertisement|Remove ads.

Nvidia Expected To Announce Spectrum CPO Technology Roadmap At GTC: Retail Stays Neutral

Shares of Nvidia Corp. (NVDA) will be in focus this week as the company is expected to announce the roadmap for its spectrum co-packed optics (CPO) technology at the upcoming bi-annual developer conference, GTC 2025.

Baird has an ‘Outperform’ rating for Nvidia and a price target of $195, implying an upside of over 60% from Friday’s closing price.

Analysts at Baird said in a recent research note to clients that the AI bellwether could unveil Spectrum CPO's technology roadmap as it seeks to enhance the power efficiency of its Blackwell platform.

The brokerage underscored the significant reduction in power and latency thanks to the CPO technology while simultaneously increasing bandwidth.

However, this technology is expected to increase costs while the yields are expected to be “possibly challenging” during the initial production runs.

Baird added that it expects initial shipments of CPO to begin in the second half of 2026, with low volumes.

It added that Nvidia’s technology ramp-up for CPO is on track so far, while peers like Broadcom Inc. (AVGO) and Advanced Micro Devices Inc. (AMD) are “presumably” set for a ramp, too.

Nvidia is expected to make a slew of announcements at its GTC 2025 event, which will begin on Mar. 17 and continue until Mar. 21 in San Jose, California. This bi-annual event draws developers, investors, engineers, researchers, and others worldwide.

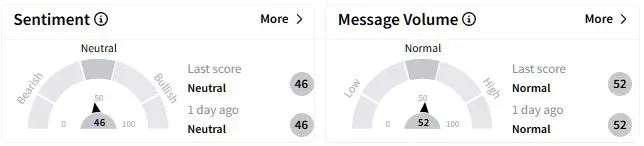

Retail sentiment on Stocktwits around the Nvidia stock remained ‘neutral’ at the time of writing, showing that investors would rather wait for announcements to trickle in.

Data from Koyfin shows the average price target for Nvidia is $172.50, implying an upside of over 41% from current levels.

Of the 62 analyst ratings for the Nvidia stock, 57 have a ‘Buy’ or ‘Strong Buy’ rating, while five have a ‘Hold’ recommendation.

Nvidia’s stock has declined over 9% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)