Advertisement|Remove ads.

Nvidia Looks To End A Five-Day Losing Streak – Retail Believes ‘The Next Growth Wave Is Unfolding Now’

- The stock price decline was amplified by a global selloff in software shares, as investors kept pulling back amid concerns about challenges posed by the rise of artificial intelligence.

- According to a Reuters report, Nvidia CEO Jensen Huang countered the growing investor anxiety that AI is undermining the global software industry.

- The bulk of the increased capital expenditures by tech companies is expected to support AI infrastructure, where Nvidia’s chips play a central role.

Nvidia Corp. (NVDA) has become one of the most closely watched names on Friday as the stock looks to end a five-day losing streak, which was amplified by a global selloff in software stocks.

The decline reflects sector-wide caution rather than company-specific news, as investors kept pulling back from sectors they think are increasingly challenged by the rise of artificial intelligence.

CEO’s Pushback On AI Fears

According to a Reuters report, On Wednesday, Nvidia CEO Jensen Huang countered the growing investor anxiety that AI is undermining the global software industry, saying the fear misunderstands how AI systems actually function.

"There's this notion that the tool in the software industry is in decline, and will be replaced by AI. It is the most illogical thing in the world, and time will prove itself," said Huang.

Another factor clouding the AI bellwether’s outlook is the growing push by tech companies to develop their own AI processors, directly challenging NVIDIA’s core products.

Nvidia's stock traded over 2% higher in Friday’s premarket.

Big Tech Spending Fuels Optimism

Supporters of the bullish case point to aggressive capital expenditure plans by major technology companies to build out data centers and AI infrastructure, which are expected to drive long-term demand for high-performance chips and eventually benefit Nvidia.

On Thursday, Amazon (AMZN) revealed plans to sharply increase capital expenditures, amounting to about $200 billion in 2026. The bulk of that investment is expected to support cloud infrastructure and artificial intelligence initiatives, areas where Nvidia’s chips play a central role.

What Are Stocktwits Users Saying?

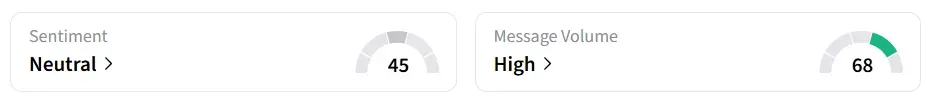

On Stocktwits, retail sentiment around the stock remained in ‘neutral’ territory amid ‘high’ message volume levels.

A bullish user said Nvidia is at the center of the massive AI investments and that ‘the next growth wave is unfolding now.’

NVDA stock has gained over 33% in the last 12 months.

Also See: Why Did BNAI Stock Soar 44% Pre-Market Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)