Advertisement|Remove ads.

Why Did BNAI Stock Soar 44% Pre-Market Today?

- The termination of the Standby Equity Purchase Agreement, originally signed on Aug. 26, 2024, is effective immediately with no remaining obligations.

- The company had only utilized the facility once since its 1-for-10 reverse stock split became effective on Dec. 12, 2025.

- Following the changes, the company currently has around 5.8 million shares outstanding.

Brand Engagement Network, Inc. (BNAI) announced on Thursday that it has ended its agreement with YA II PN, Ltd., an affiliate of Yorkville Advisors Global, LP, that allowed the company to sell up to $50 million of its stock.

The termination of the Standby Equity Purchase Agreement, originally signed on Aug. 26, 2024, is effective immediately with no remaining obligations.

Facility Use And Reverse Split

The company had only utilized the facility once since its 1-for-10 reverse stock split became effective on Dec. 12, 2025. Brand Engagement’s management chose to terminate the standby agreement, ensuring no outstanding draws or debts remain under the previous arrangement.

This step is part of a broader effort to streamline financing. Following the update, Brand Engagement’s stock traded over 44% higher in Thursday’s premarket.

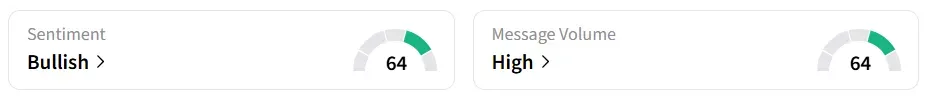

On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘high’ message volume levels.

Private Placement And Balance Sheet

The company recently completed the first installment of a $1.518 million premium private placement and plans to close the remaining portions in February and March 2026. The company highlighted that recent warrant exercises, debt conversions, and private placement activities have reinforced its financial position, maintaining liquidity without major shareholder dilution.

"We remain focused on maintaining a disciplined capital strategy and a clean capital structure as we scale revenue-generating deployments,"

-Tyler Luck, CEO, Brand Engagement Network.

Following these changes, the company currently has around 5.8 million shares outstanding, with approximately 3.3 million shares available in the public float.

In late January, The AI-driven chat company gained attention after revealing a partnership with Valio Technologies to license its AI in South Africa.

BNAI stock has gained over 471% in the last 12 months.

Also See: Meta Stock Sees Retail Caution Amid Big Tech’s AI Investment Surge

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1232171389_jpg_55d81c88fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_b7abd92483.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)