Advertisement|Remove ads.

Nvidia Positioned To Lead AI Wave, Says Cantor Fitzgerald

Nvidia Corp. (NVDA) continues to cement its role as the central force behind the artificial intelligence revolution, according to a recent analysis by Cantor Fitzgerald.

The firm characterized Nvidia as the essential backbone of AI infrastructure, suggesting that the company's technology is driving much of the sector’s foundational growth, according to TheFly.

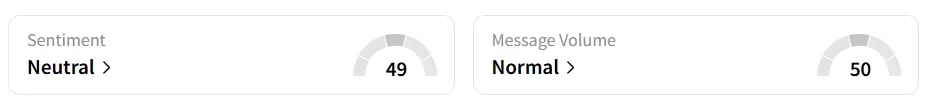

Nvidia stock inched 0.6% lower on Friday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘neutral’ territory amid ‘normal’ message volume levels.

Despite growing attention around AI, Cantor maintains that it’s "way too early" to call a peak in the trend and sees significant upside ahead.

Cantor projects that CEO Jensen Huang's forecast of AI-related infrastructure spending, ranging from $3 trillion to $4 trillion by 2030, is reasonable given the current pace of development and deployment.

Reaffirming its confidence in Nvidia, Cantor Fitzgerald assigned an ‘Overweight’ rating on the stock with a $240 price target. The firm sees Nvidia not just as a key chipmaker, but as the quarterback of the broader AI ecosystem.

According to a CNBC report, Bank of America recommends buying Nvidia, calling it one of its best investment ideas. “We continue to prefer NVDA as our top AI pick, levered to the most critical compute (accelerator) and networking (scale-up links/switches, scale-out switches, NICs, DPUs), components of the $1.2 trillion potential data center capex,” said the firm.

For the third quarter of fiscal 2026, the chip giant anticipates revenue of $54.0 billion, plus or minus 2%, compared to the analysts’ consensus estimate of $54.6 billion, according to Fiscal AI data.

Nvidia’s stock has gained over 38% year-to-date and over 51% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244672917_jpg_95b721e1af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195597245_jpg_c1df83b829.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paypal_BTC_ETH_OG_jpg_566a59dd7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2189355808_jpg_c13dd12a0f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195599761_jpg_ec0e618b8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)