Advertisement|Remove ads.

Teladoc Stock Sinks After-Hours As Q4 Loss, Revenue Outlook Disappoint — Retail Worries About Profitability Struggles

Teladoc Health Inc. shares plunged 16% in after-hours trading Wednesday after the company posted a wider-than-expected quarterly loss and issued a disappointing outlook.

Retail investors remain wary of its persistent profitability struggles, especially amid its aggressive acquisition strategy.

The company reported a Q4 loss of $0.28 per share, missing expectations of a $0.26 loss. Revenue slightly beat estimates at $640.49 million versus $639.55 million.

While Integrated Care segment revenue rose 2% to $390.7 million, the BetterHelp mental health division saw a 10% decline to $249.8 million.

For Q1 2025, Teladoc projected a loss of $0.40 to $0.15 per share, compared to the consensus loss of $0.37, while revenue guidance of $608 million to $629 million fell short of Wall Street's $633.03 million estimate.

Full-year forecasts followed suit, with an expected EPS loss of $1.10 to $0.50 (vs. a $1.03 loss consensus) and revenue guidance of $2.468 billion to $2.576 billion (vs. $2.54 billion expected).

CEO Chuck Divita, who addressed macroeconomic headwinds on the earnings call, said BetterHelp had surpassed five million users worldwide in January.

Still, he admitted that the business was operating in a "challenging environment" that weighed on Teladoc's 2024 performance and outlook for 2025.

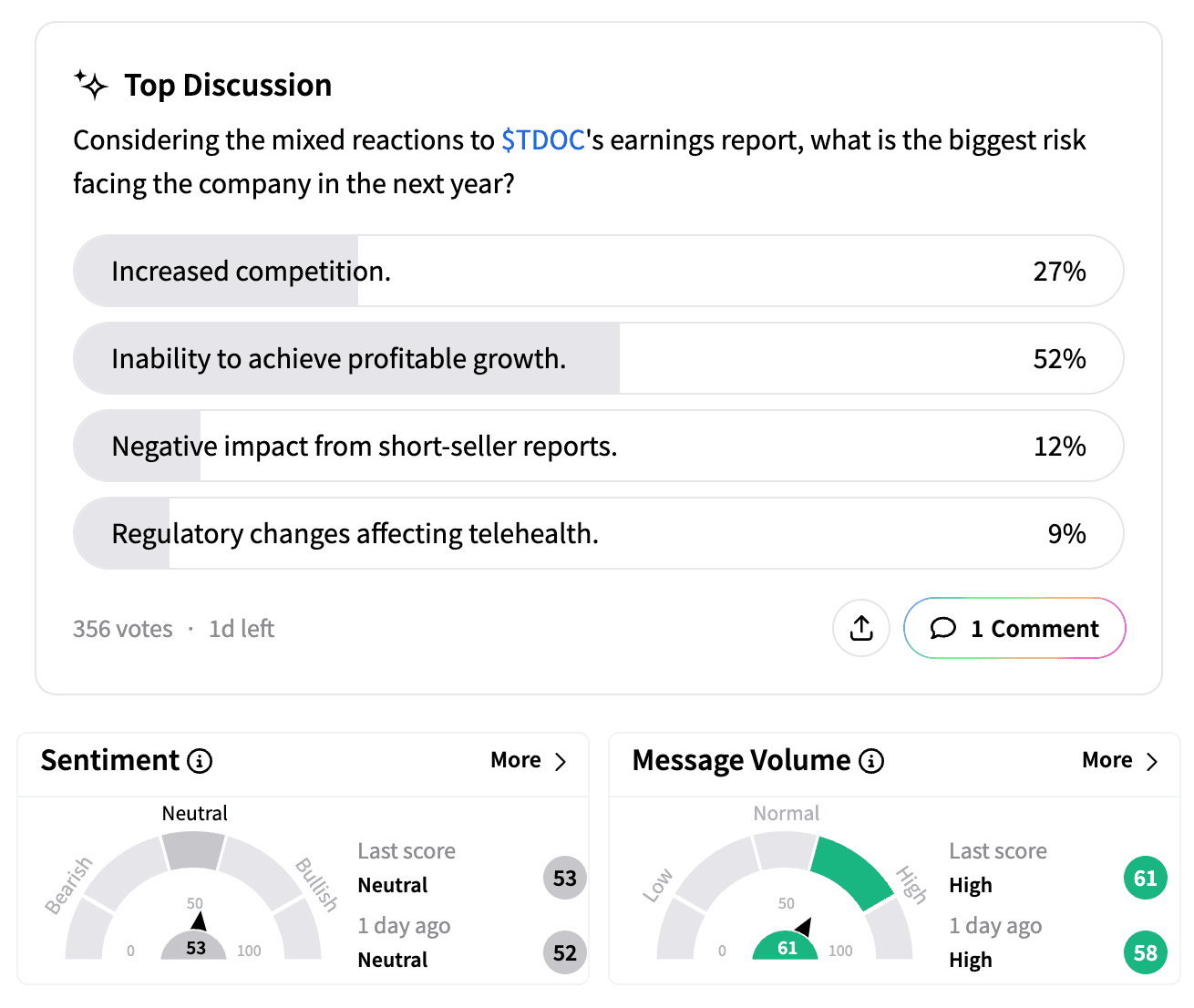

On Stocktwits, investor sentiment remained 'neutral' amid a 170% spike in message volume.

Early results from a poll on the platform revealed that 55% of respondents viewed Teladoc's inability to achieve profitable growth as the company's biggest risk over the next year, while 25% pointed to increased competition.

Some bullish investors highlighted positive aspects of the report, including a 5% rise in U.S. Integrated Care members to 93.8 million.

Skeptics were vocal, with one user posting: "At this rate, $9 under is certain this week. Shareholders getting punched in the face every ER [earnings report] for 10+ ERs."

Adding to some controversy, short-seller Blue Orca Capital disclosed a short position in Teladoc last week. It alleged the company misled investors by allowing AI-driven therapy interactions on BetterHelp and accused it of overstating profitability and cash flow via questionable accounting.

Teladoc's legal team denied the allegations before its earnings report.

Teladoc, which thrived during the COVID-19 pandemic, has struggled to sustain growth amid rising competition and financial setbacks.

Earlier this month, it announced a $65 million all-cash acquisition of virtual preventive care provider Catapult Health, with up to $5 million in potential earnouts. The deal is expected to close in Q1 2025.

Following the ouster of CEO Jason Gorevic last year, Teladoc has been charting a recovery path.

As of the last close, shares remain up nearly 17% this year. According to Koyfin data, short interest in the stock stands at 13.3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_New_York_Times_resized_jpg_37d8dd3b33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_meta_OG_jpg_187c6126ee.webp)